Sebi looks to expand mutual fund categories

Recent Post

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

19-yr-old runner dies after cardiac arrest

2025-06-20

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

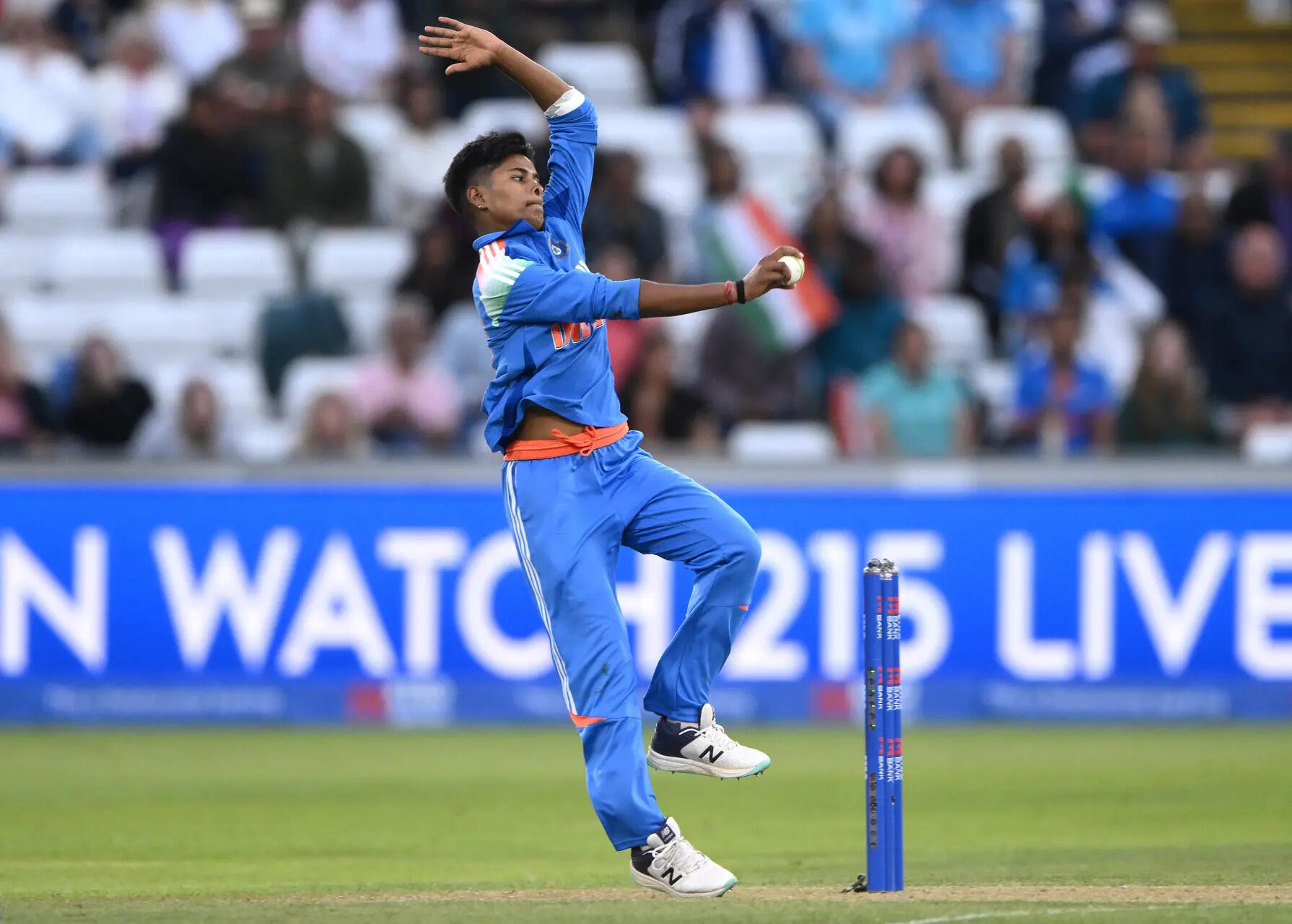

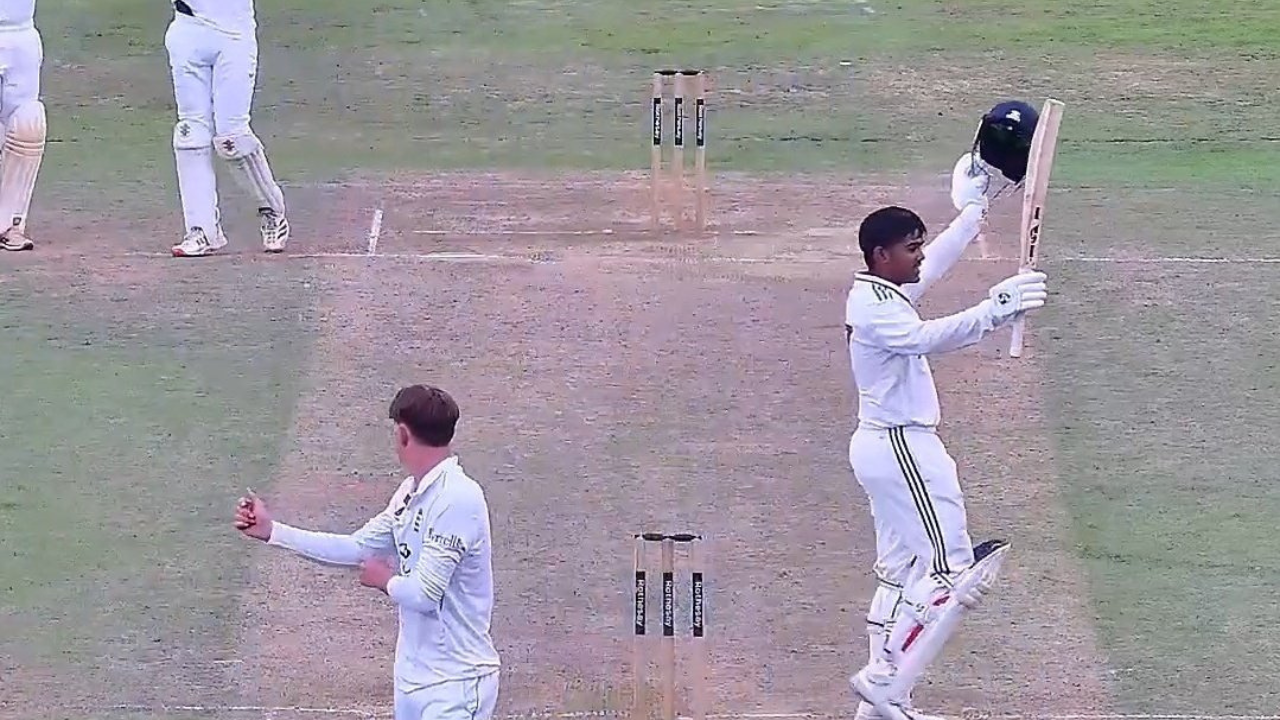

IND vs ENG: 'He can bat all day like Dravid'

2025-06-20

-

-

-

-

-

-

-

-

-

-

-

-

-

-

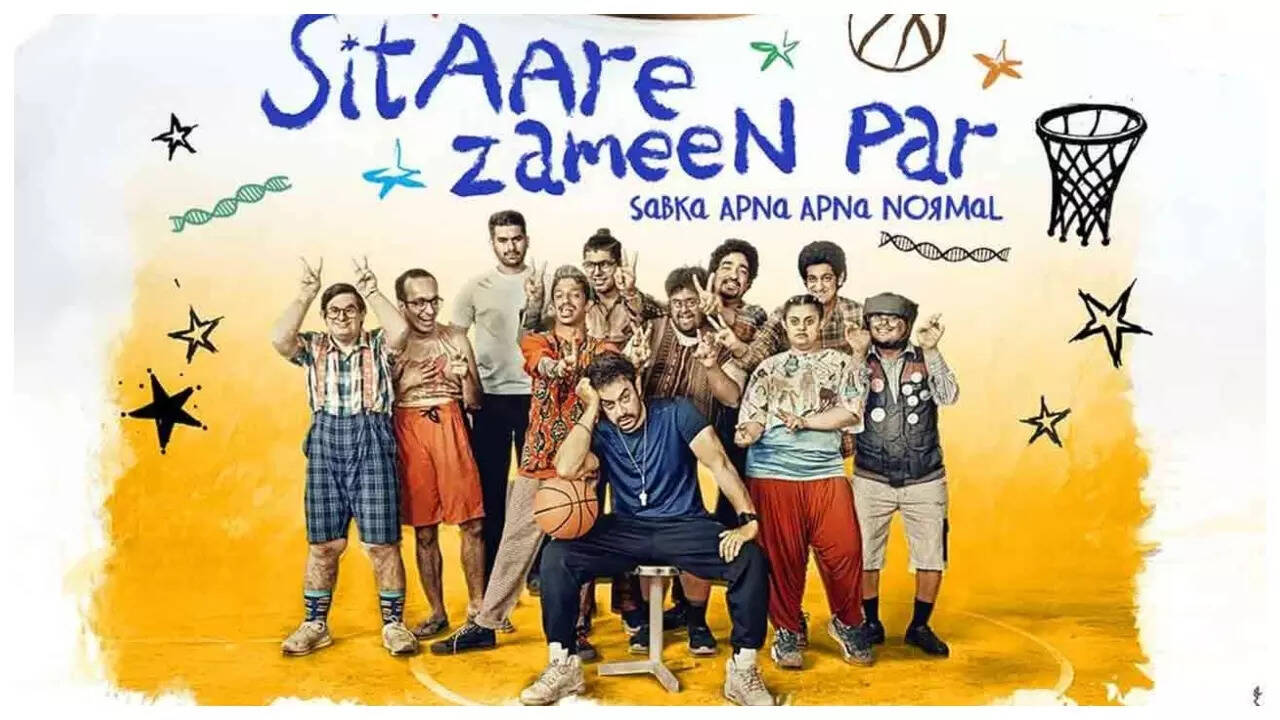

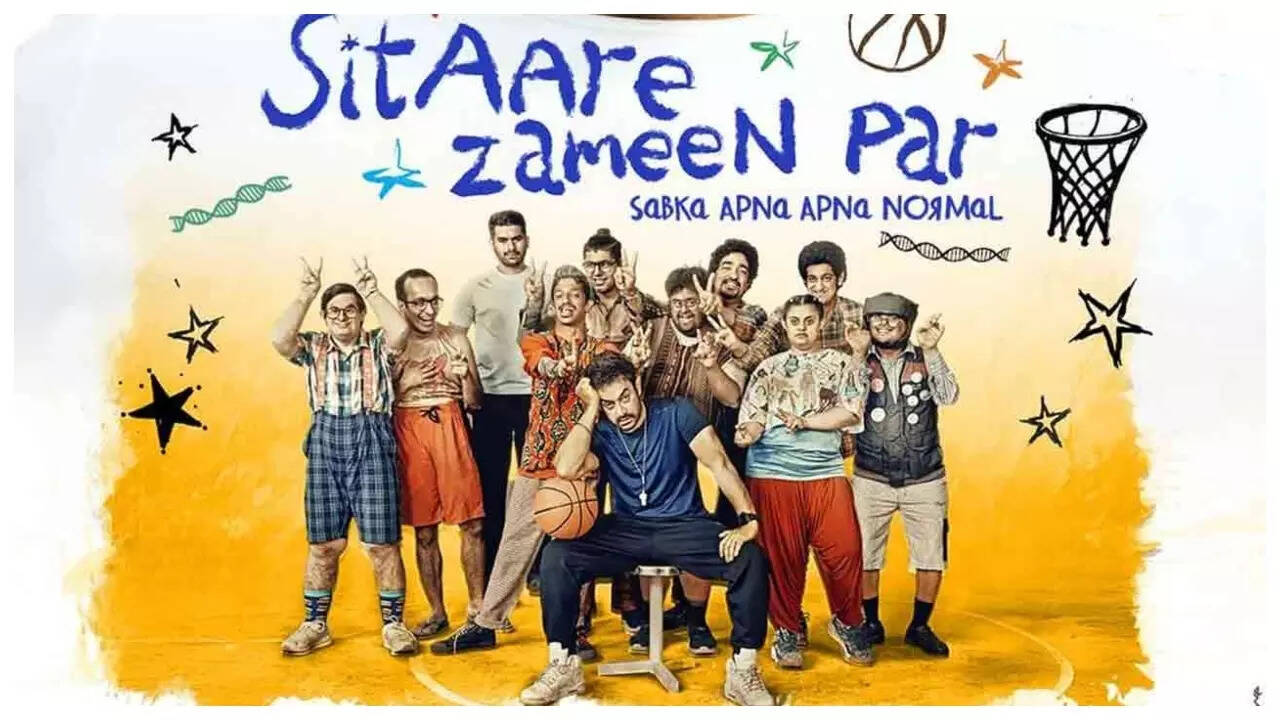

Sitaare Zameen Par Live Blog

2025-06-20

-

Kajol watches horror films without sound

2025-06-20

-

'Prince and Family' OTT release

2025-06-20

-

Aamir Khan's top 5 movies to watch on OTT

2025-06-20

-

-

-

-

Best Bollywood cameos of all time

2025-06-20

-

‘Sitaare Zameen Par’ Twitter Reviews

2025-06-20

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Juhi Chawla touches Asha Bhosle's feet

2025-06-20

-

-

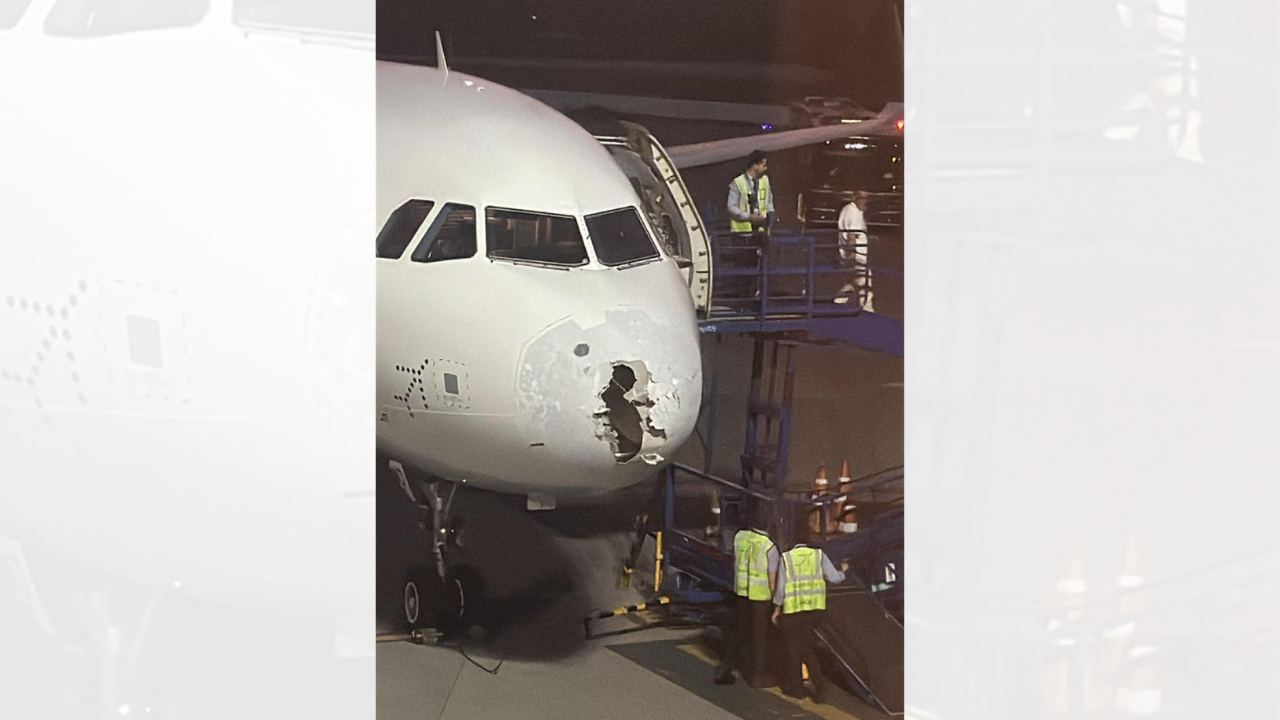

Suchitra apologises to Air India survivor

2025-06-20

-

‘Was made to wait by Nixon for an hour’: BJP

2025-06-20

-

-

-

-

-

-

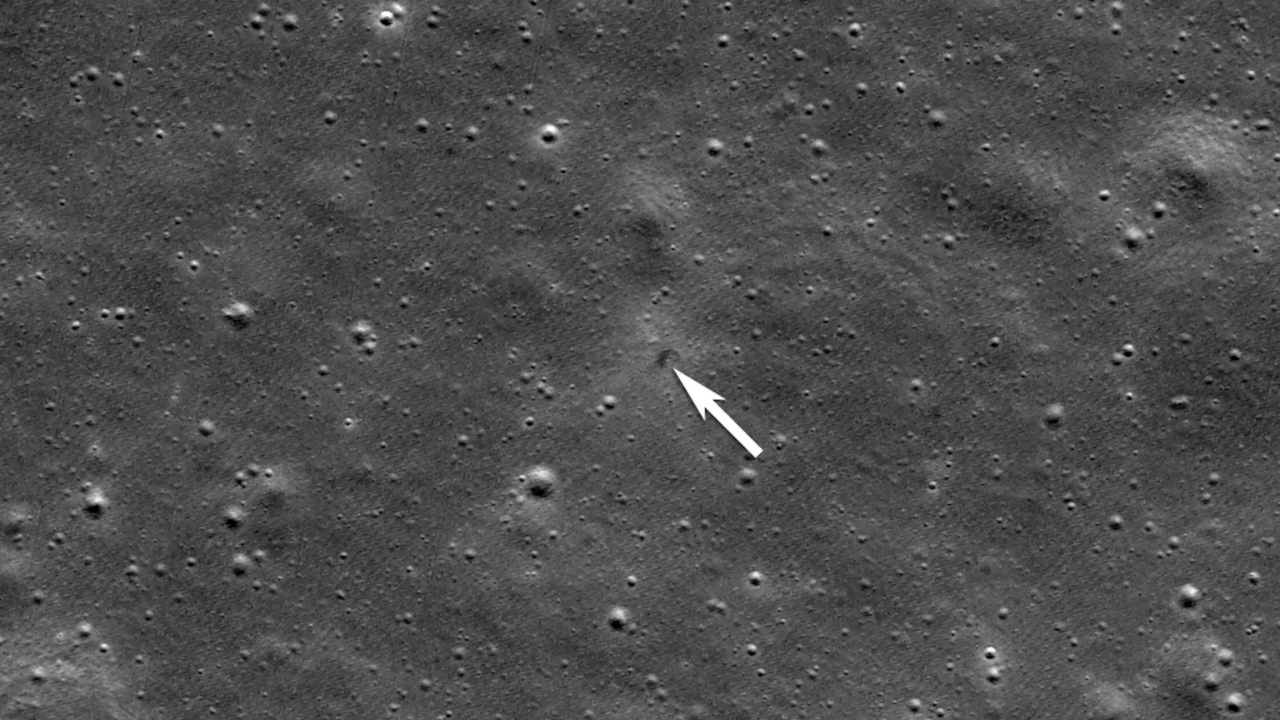

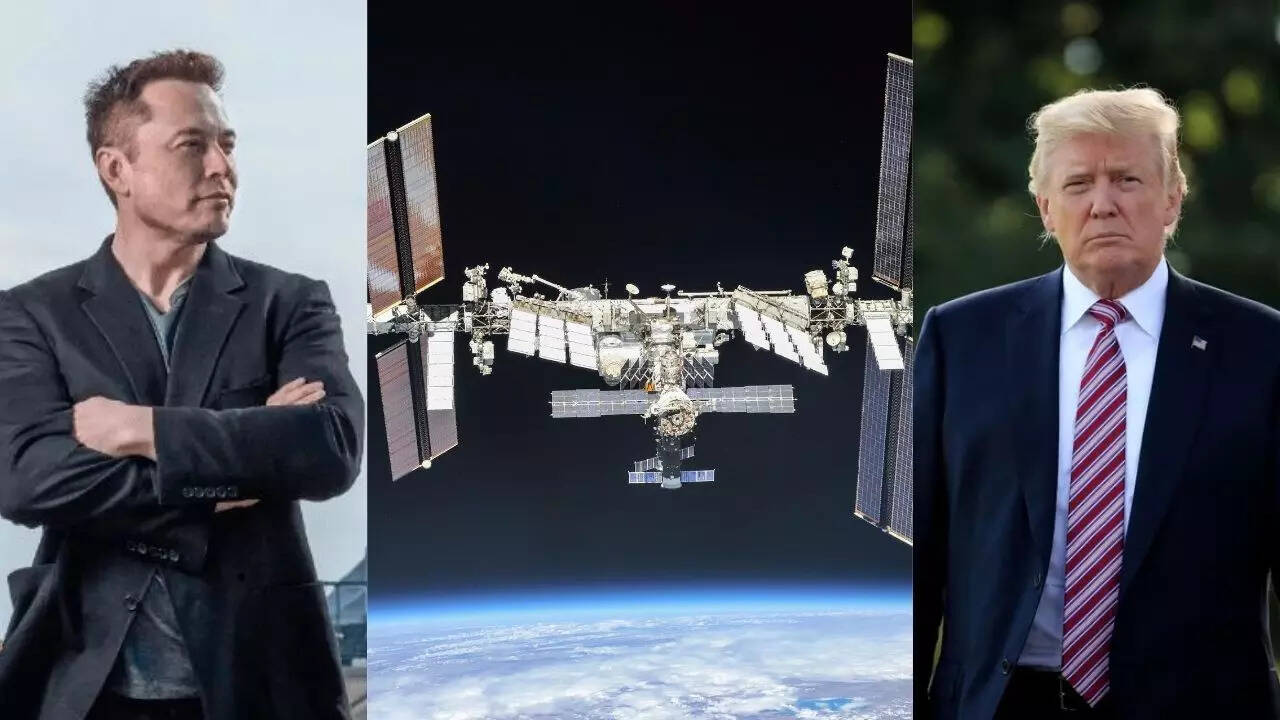

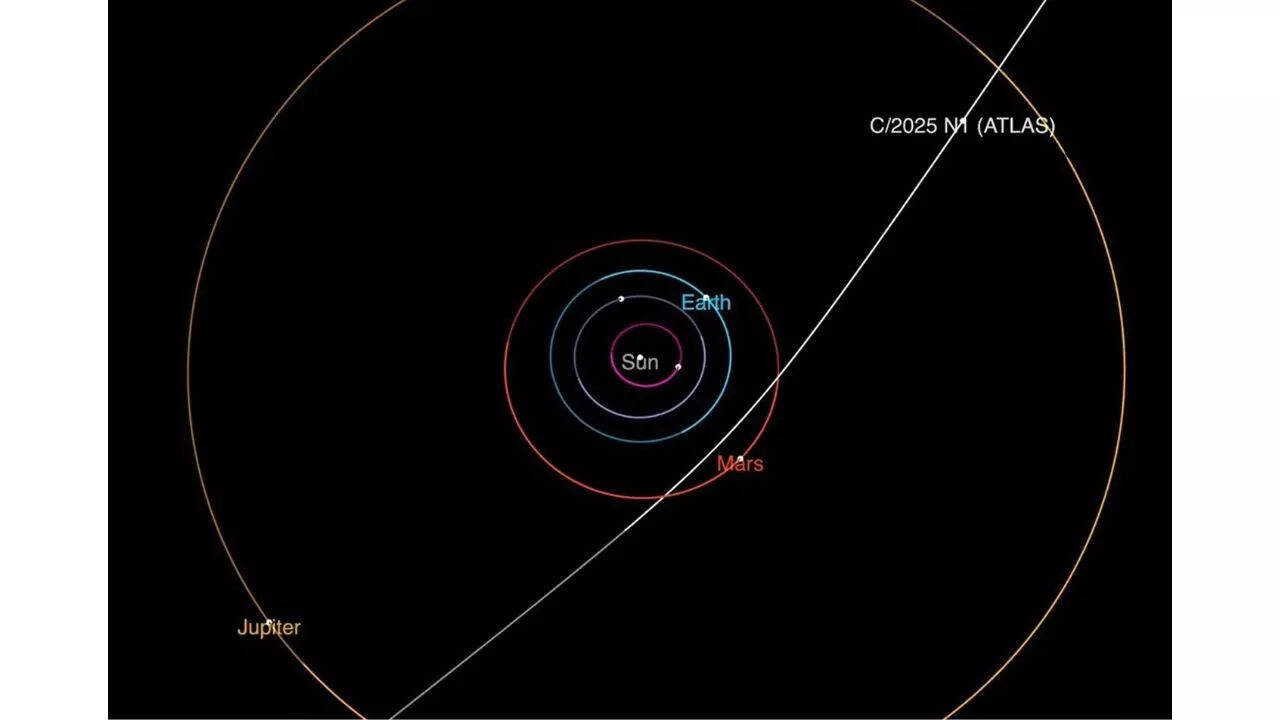

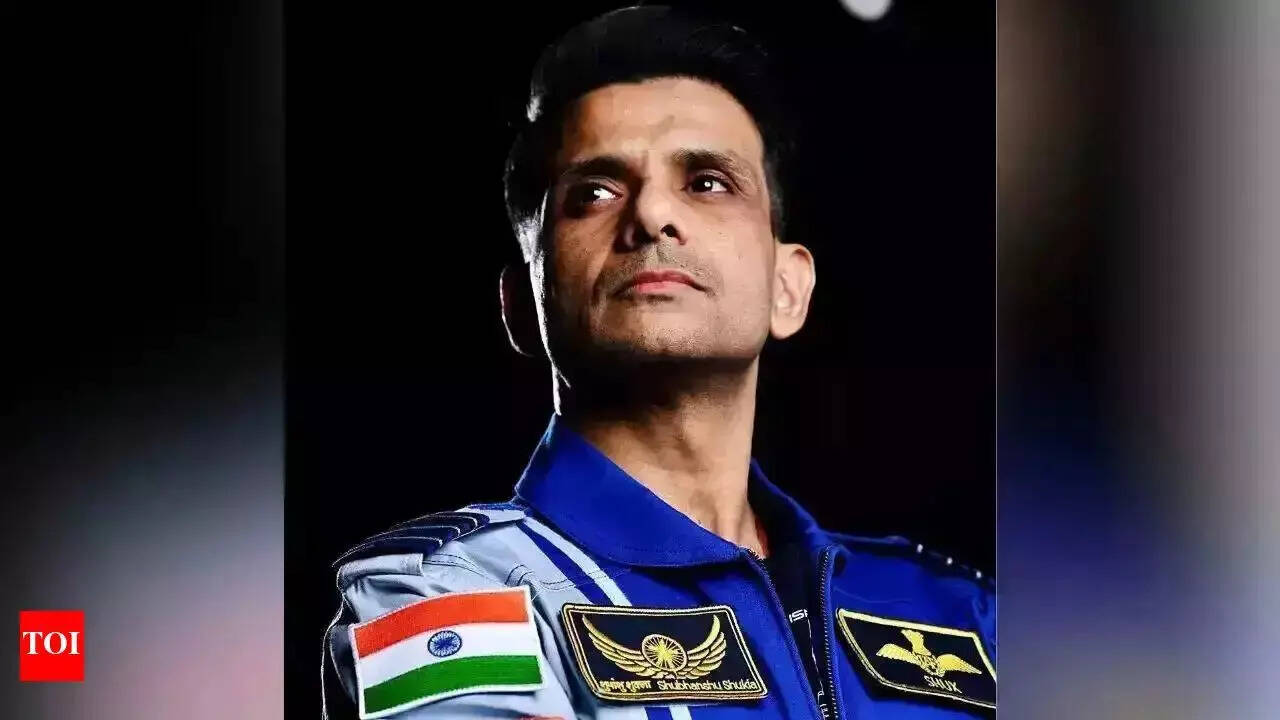

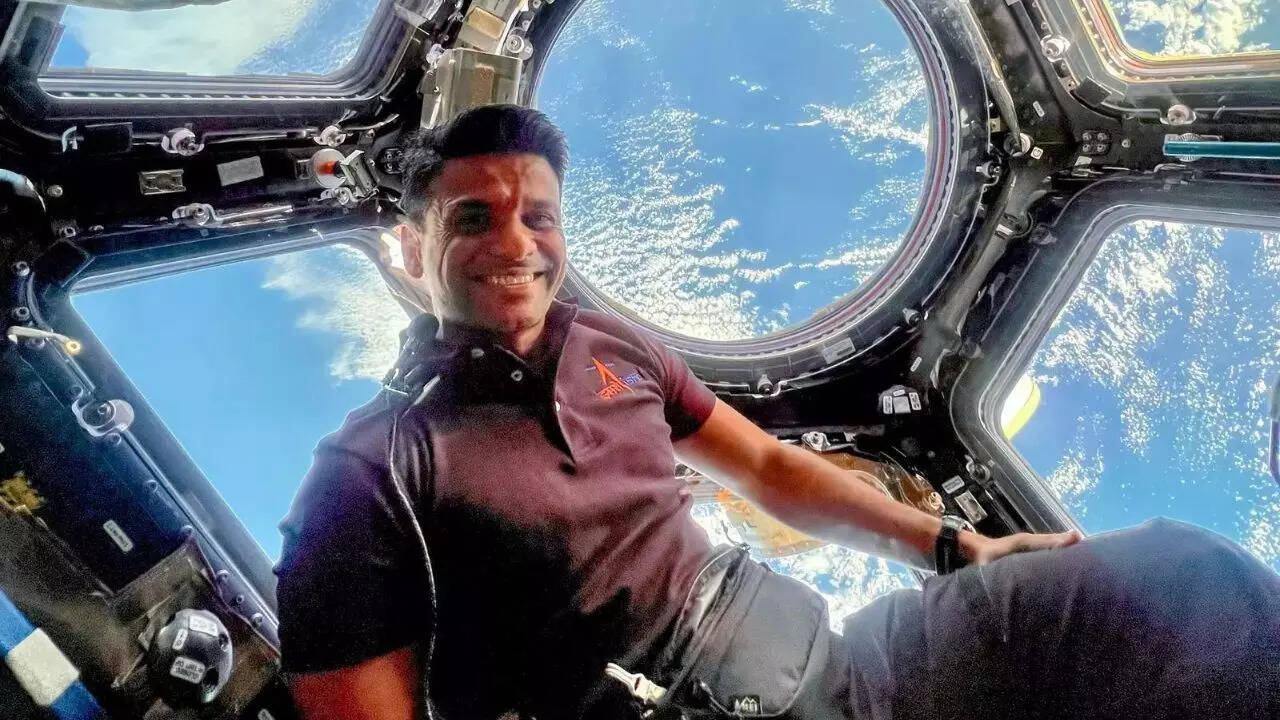

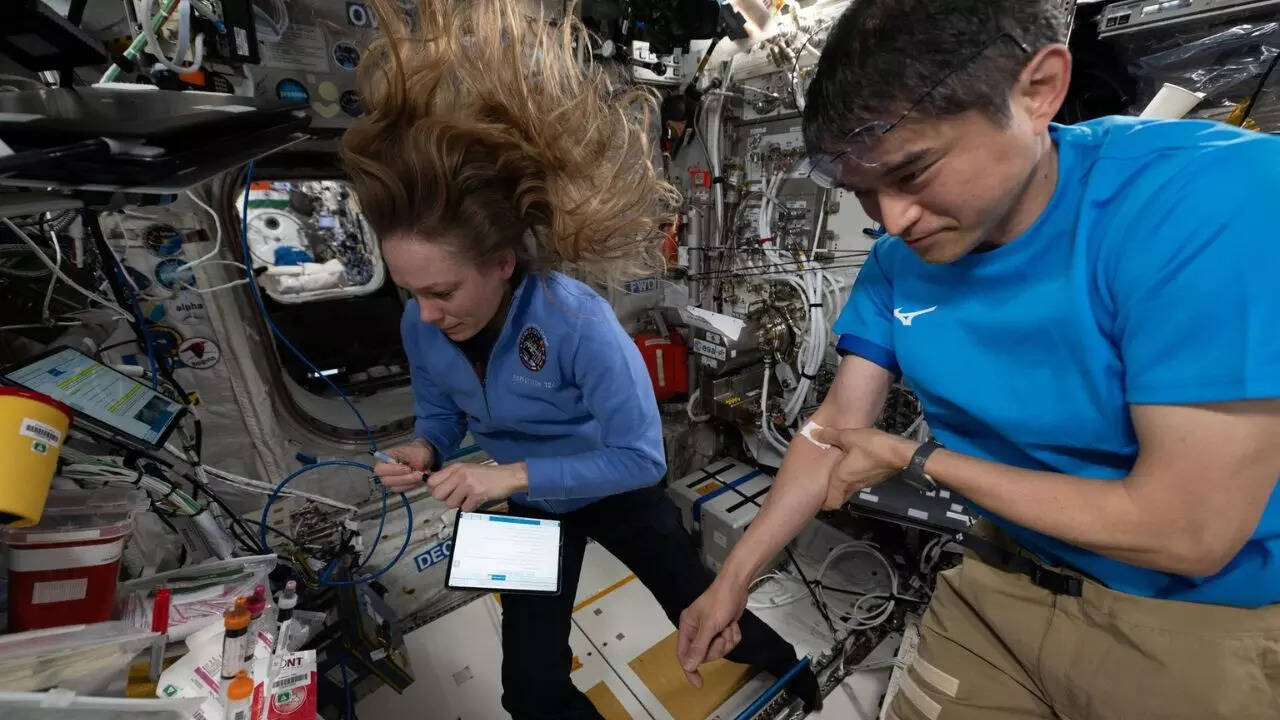

Ax-4 Pushed Back Again, No New Date Yet

2025-06-20

-

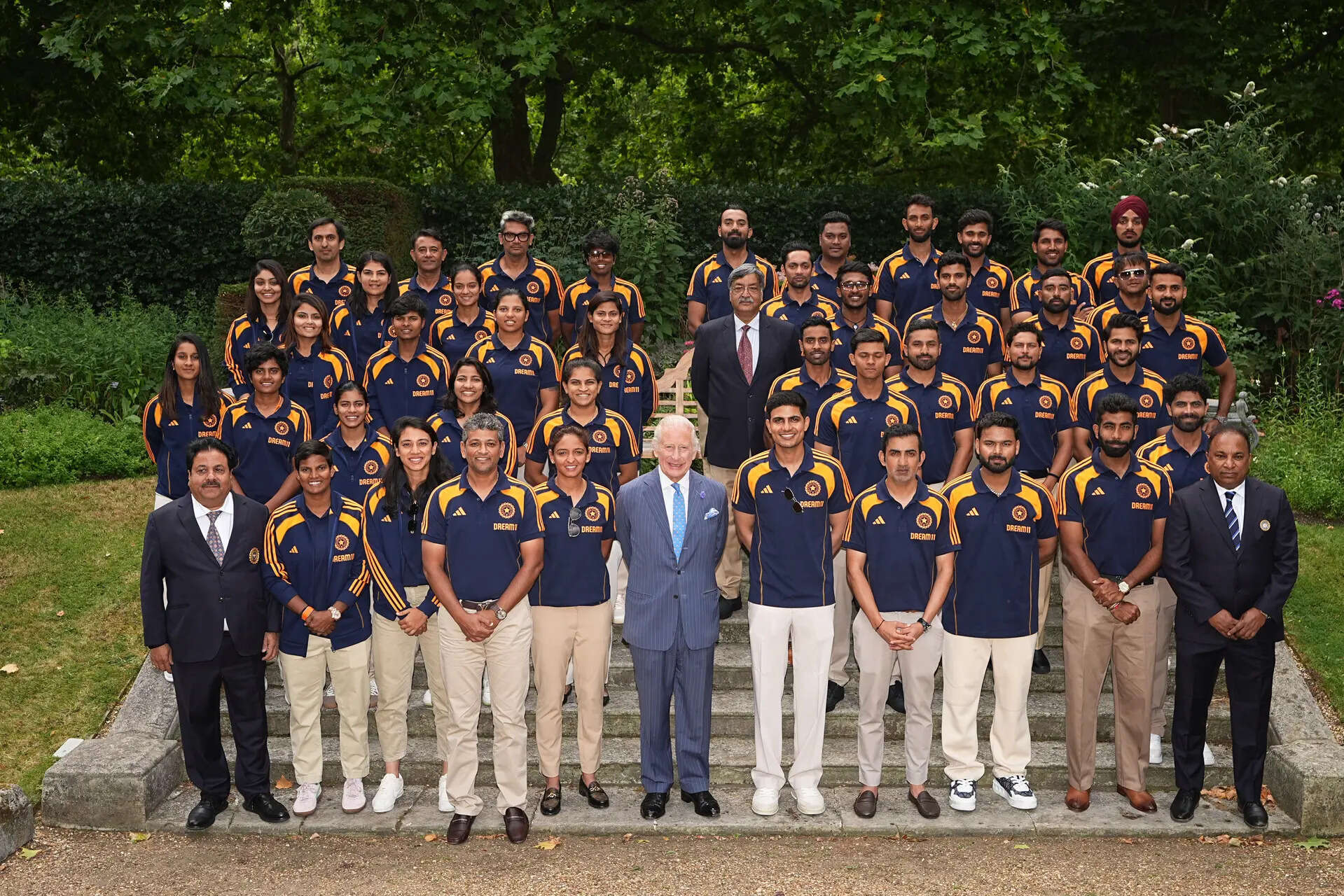

Meet this year’s #Unstoppable21

2025-06-20

-

-

-

-

-

-

-

-

-

Who said what in India's camp ahead of 1st

2025-06-20

-

-

-

-

-

-

-

-

-

-

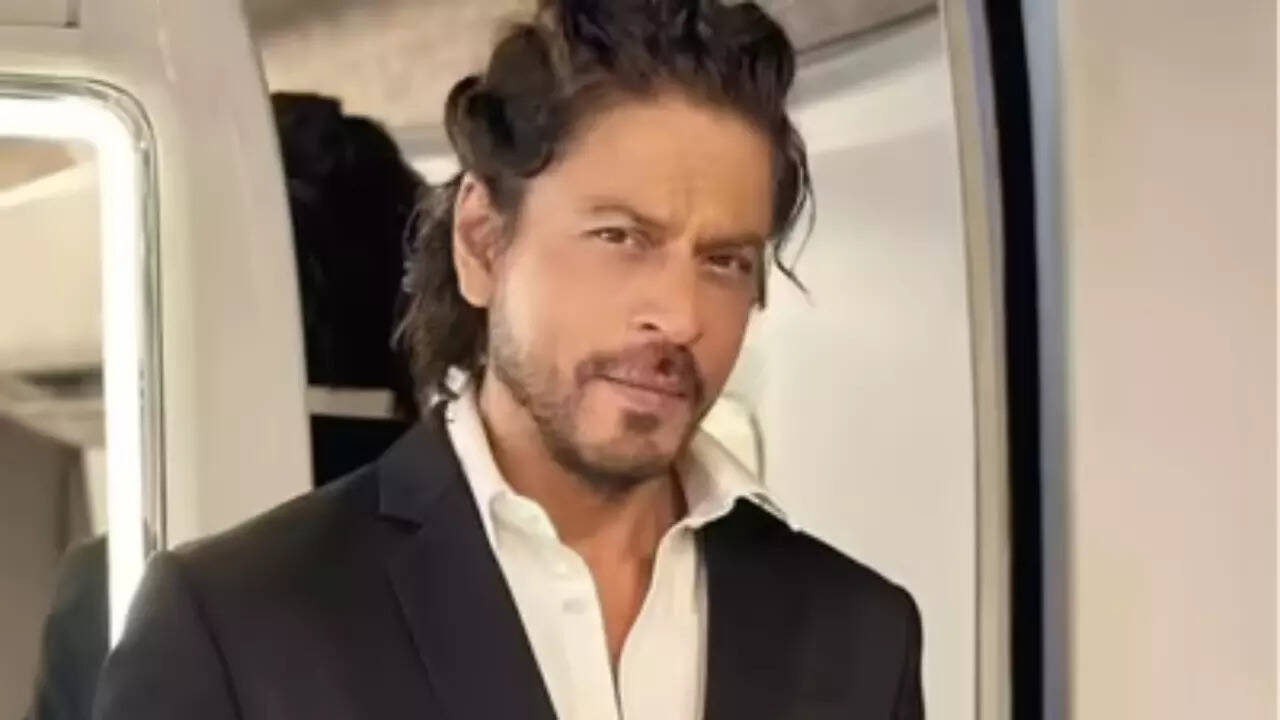

When SRK teased Aamir over a cup of tea

2025-06-20

-

-

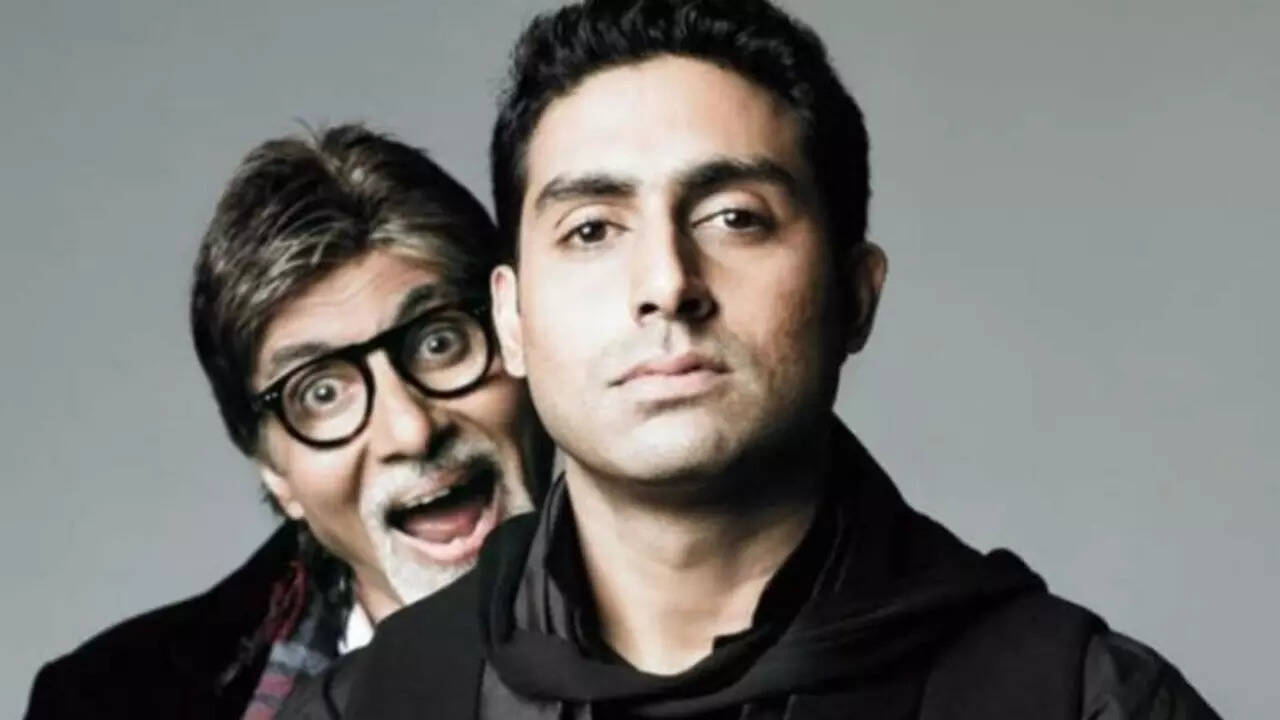

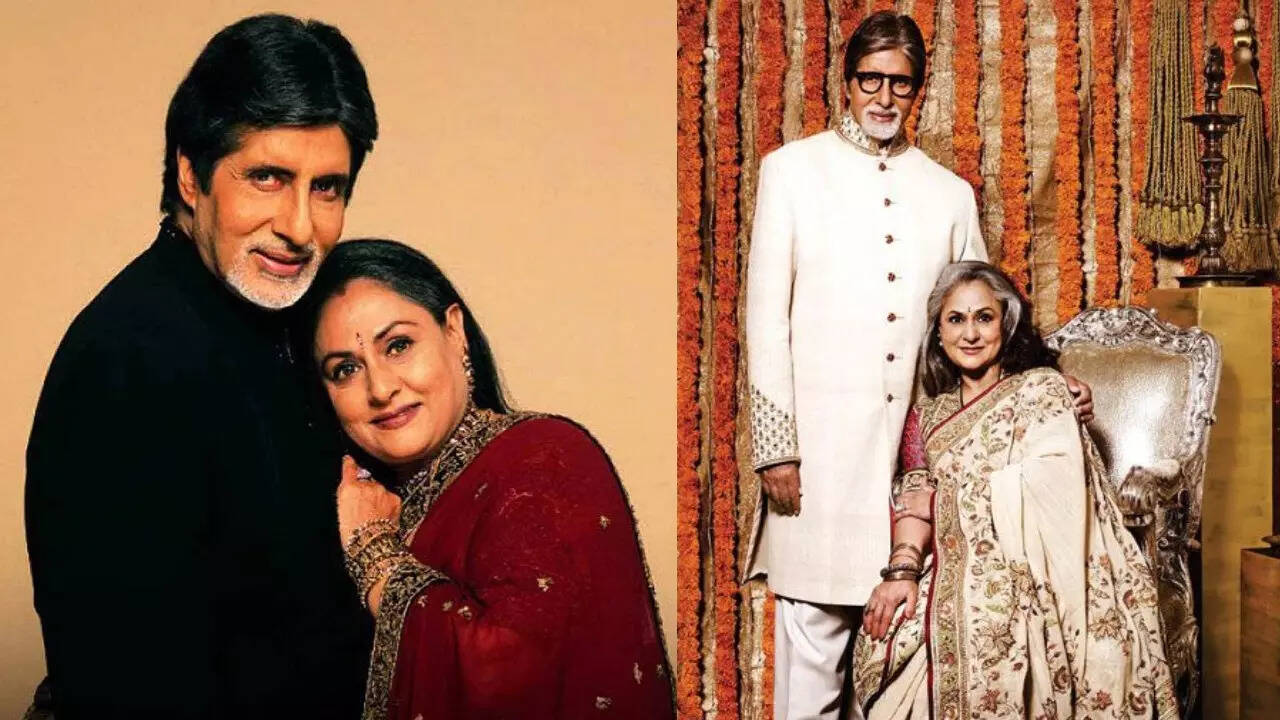

Amitabh calls working with son Abhishek

2025-06-20

-

-

Movie Review: Sitaare Zameen Par - 3.5/5

2025-06-20

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IND vs ENG: 'Kya hi baat hai teri bhai' -

2025-06-21

-

-

-

-

-

-

-

Netizens react to Sudhanshu slamming Apoorva

2025-06-21

-

When Aishwarya said, 'I'm not a narcissist'

2025-06-21

-

-

-

-

-

-

-

Vicky on Katrina : “I Just Want to See Her

2025-06-21

-

-

-

-

Housefull 5 all set to beat Raid 2 as 2nd

2025-06-21

-

-

-

SZP 's day 1 falls short of 3 Idiots

2025-06-21

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Capillary to raise Rs 430cr via fresh issue

2025-06-21

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Now, RJD, Moitra & PUCL move Supreme Court

2025-07-07

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Best memes that defined Hindi pop culture

2025-07-07

-

-

-

Kriti's note for Ranveer fuels 'Don 3' buzz

2025-07-07

-

-

Kajol ran away from boarding school at 11

2025-07-07

-

-

-

Kajol starrer ‘Maa’ crosses Rs 30 crore mark

2025-07-07

-

-

'SZP' inches closer to 150 crores in India

2025-07-07

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

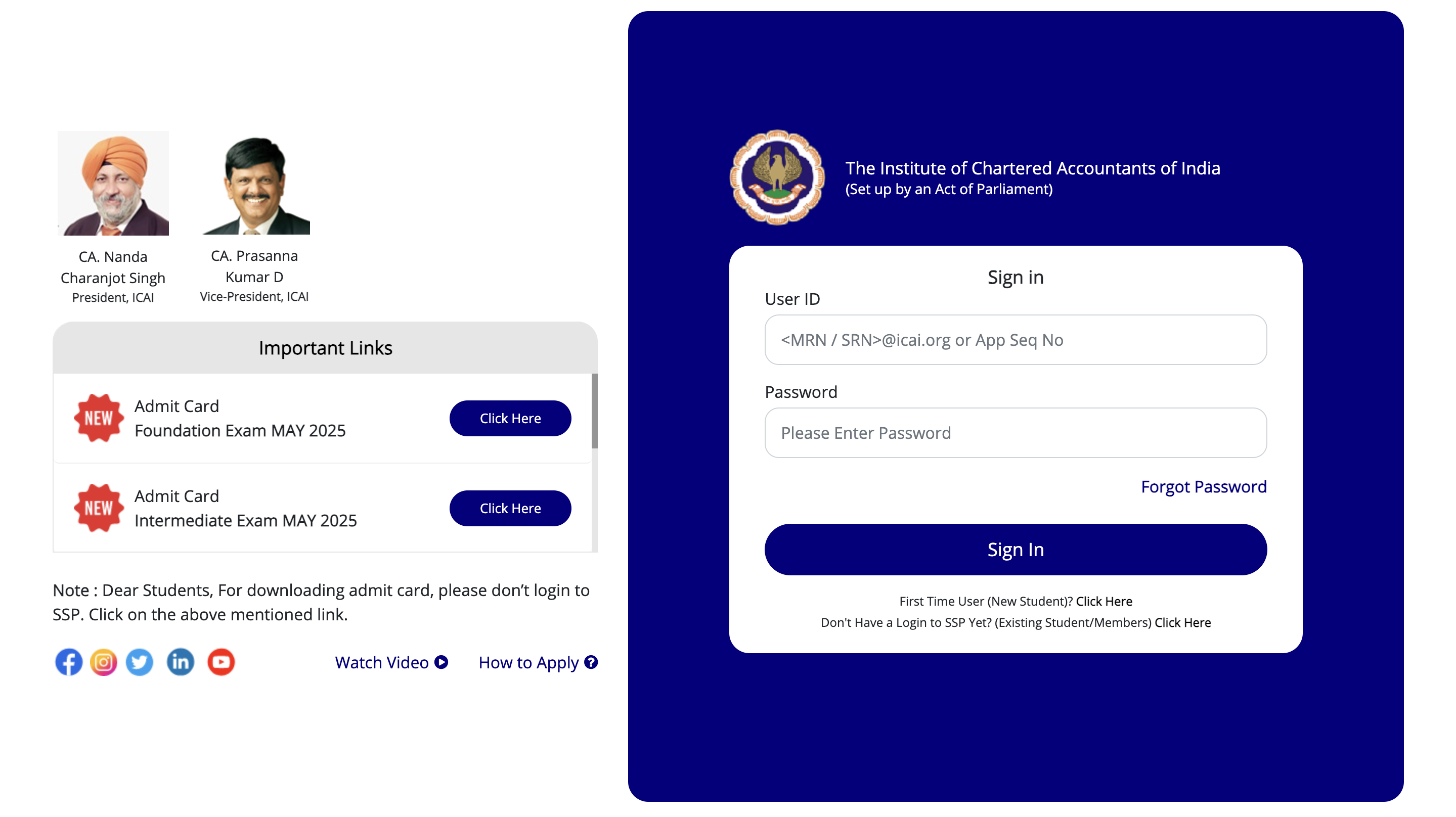

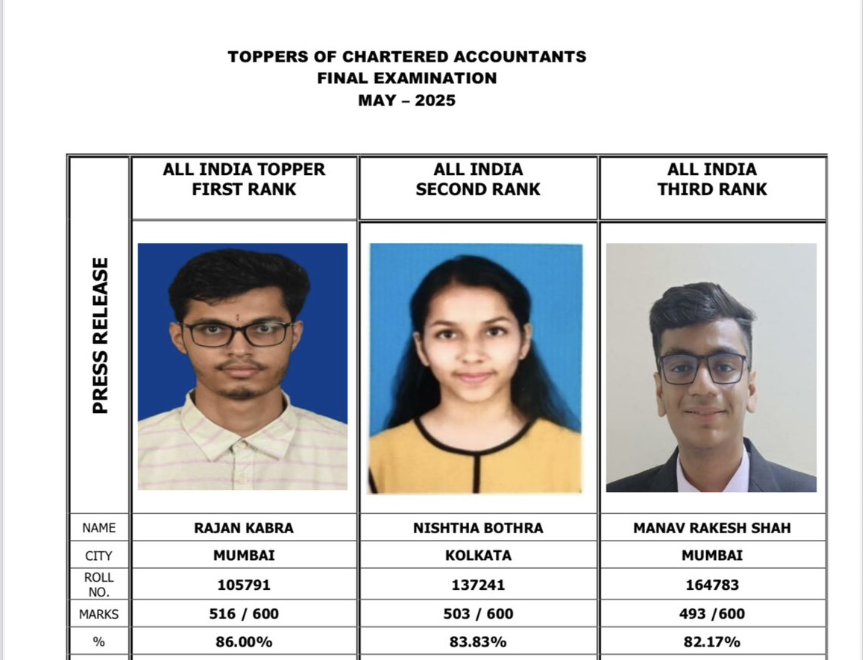

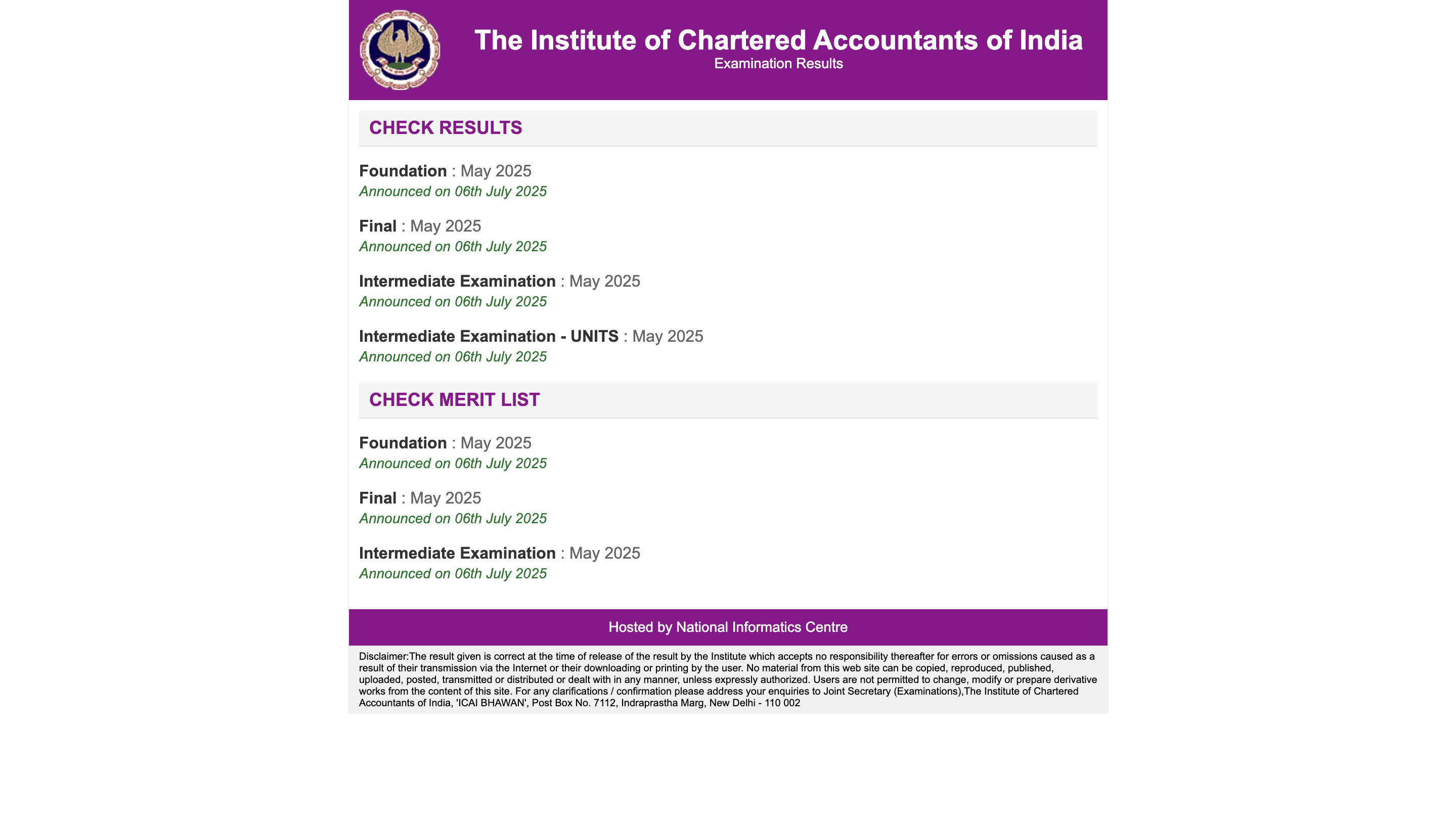

Who is Rajan Kabra? Meet the CA Final AIR 1

2025-07-07

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Why Jane St ban may not hit trading

2025-07-07

-

-

PSBs may remove min balance fines

2025-07-07

-

How much would you pay for 10-min delivery?

2025-07-07

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Ronit deployed security personnel for Aamir

2025-07-15

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Telangana: Congress functionary shot dead

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Sid-Kiara’s romantic pictures

2025-07-16

-

'Superman' crosses Rs 30 crore mark in India

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

77th Emmy Awards Nominations 2025 full list

2025-07-16

-

-

-

-

-

-

Trump tariff war: Deal or no deal - why it

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Ranbir Kapoor’s Quiet Prayer’: Exclusive

2025-07-16

-

-

-

-

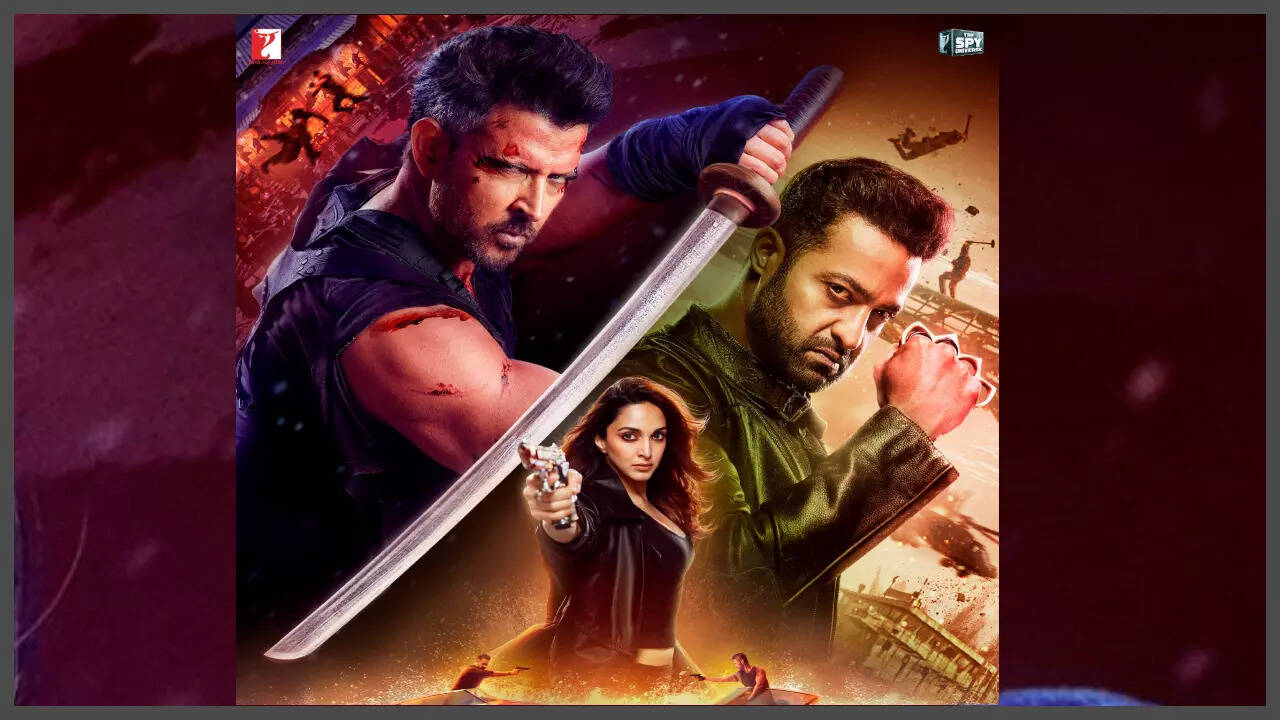

Kingdom Takes a Promising Start in the USA

2025-07-16

-

-

Samay Raina submits a written apology to NCW

2025-07-16

-

Actress Sumi found wandering in Bardhaman

2025-07-16

-

Stars who left us this year—Take a look

2025-07-16

-

-

-

Shaan on his viral meme of him abusing

2025-07-16

-

-

Happy Birthday Katrina Kaif

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Sensex gains after 4-day losing streak

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Chiranjeevi, Nayanthara to shoot love song

2025-07-16

-

Anusree - 'My father broke down in public'

2025-07-16

-

"I have stopped feeling bad or good...": RGV

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

70% of Gen Z in the US turn to social

2025-07-16

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Actress Ranya Rao gets 1-year jail term

2025-07-17

-

Saiyaara: CBFC cuts 10-second intimate scene

2025-07-17

-

-

-

-

'Aankhon Ki Gustakhiyaan’ to miss Rs 2 cr

2025-07-17

-

Emma Watson loses her driving license

2025-07-17

-

-

Superman crosses Rs 33.6 crore in India

2025-07-17

-

-

-

-

-

-

-

-

-

-

-

-

-

ITC Hotels net rises 53% to Rs 134 crore in

2025-07-17

-

-

-

-

-

-

-

India hikes flying rights for Kuwait

2025-07-17

-

-

-

-

Your screening interview may be with a bot

2025-07-17

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

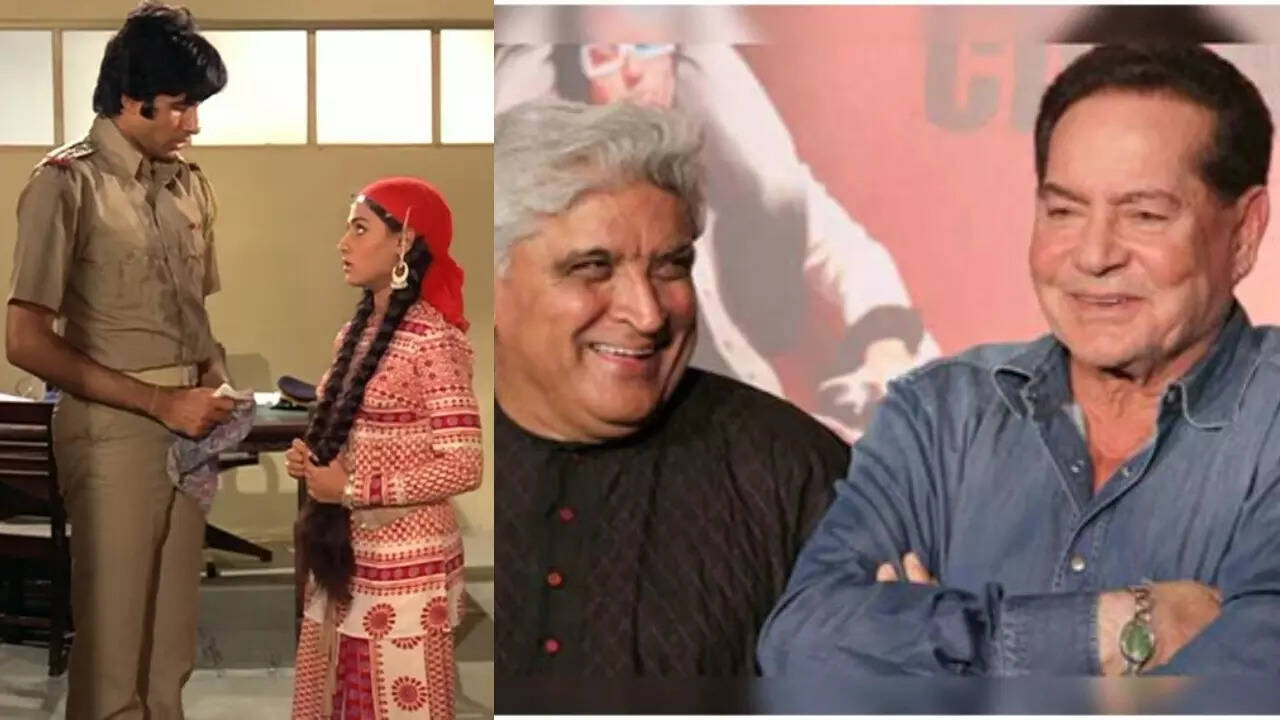

Harshaali remembers Salman’s words of advice

2025-07-17

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Anupam Kher on clash with Aamir Khan

2025-07-18

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

5 elite US colleges that can burn a hole in

2025-07-18

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

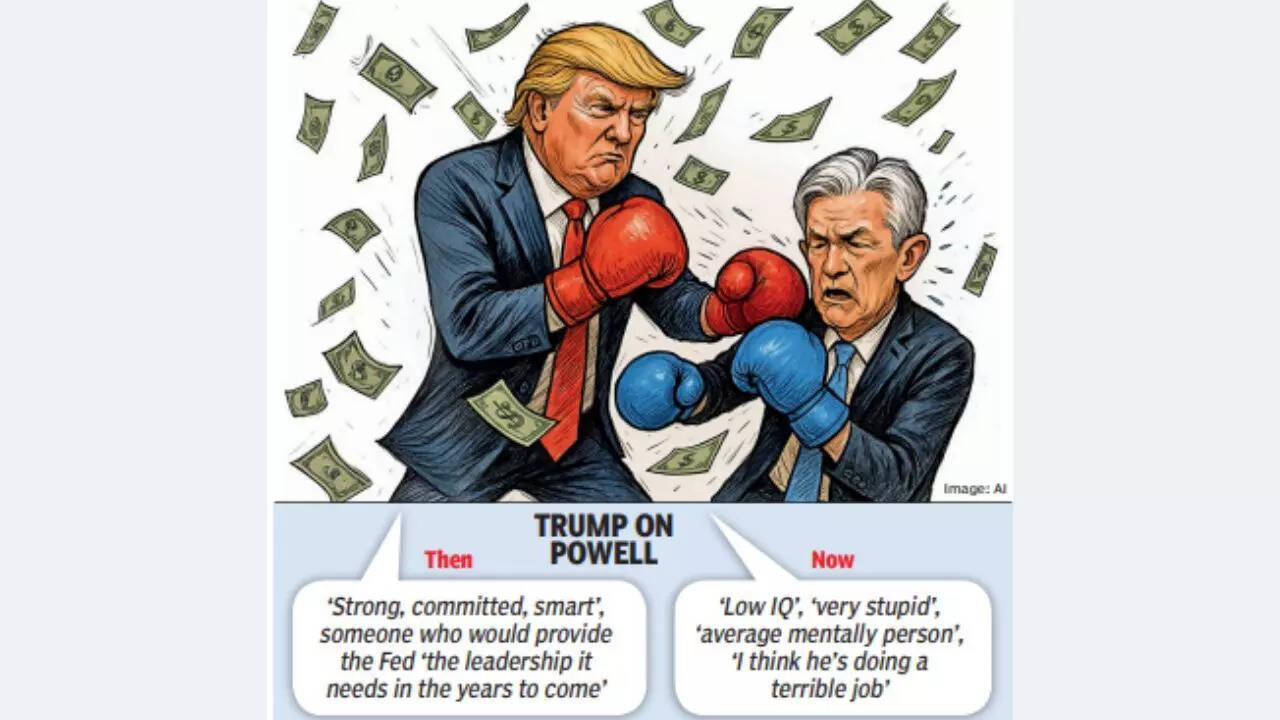

My rate vs your rate: Govt vs central banks

2025-07-18

-

-

-

-

-

-

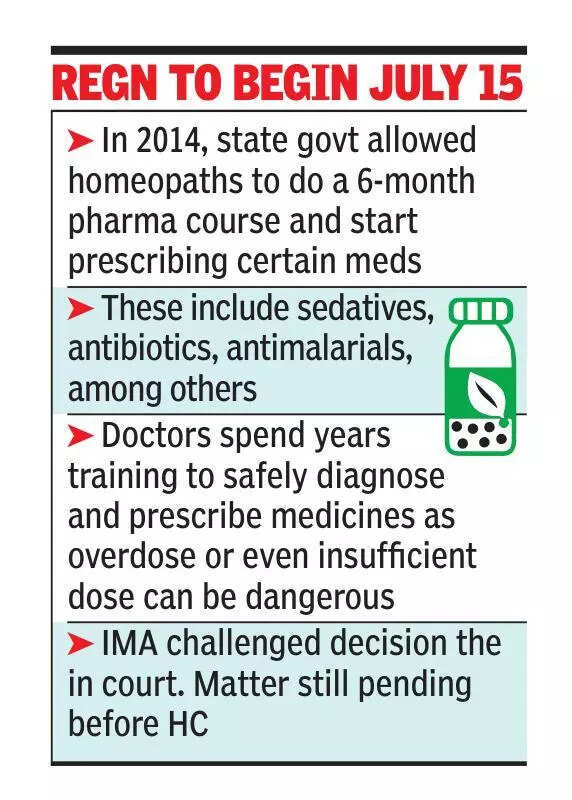

Kerala raises legal toddy alcohol limit

2025-07-18

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Director Velu Prabhakaran passes away at 68

2025-07-18

-

-

-

-

-

-

-

Sitaare Zameen Par mints Rs. 163 crore

2025-07-18

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Wipro revenue drops 2.3% in June quarter

2025-07-18

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

In a first, 9 sentenced to life by court in

2025-07-19

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

SZP writer on working with Aamir Khan

2025-07-19

-

Upcoming OTT releases of the week

2025-07-19

-

-

'Ronth' OTT release details

2025-07-19

-

Fish Venkat passes away at 53

2025-07-19

-

-

-

-

Coldplay's crazy concert moments

2025-07-19

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

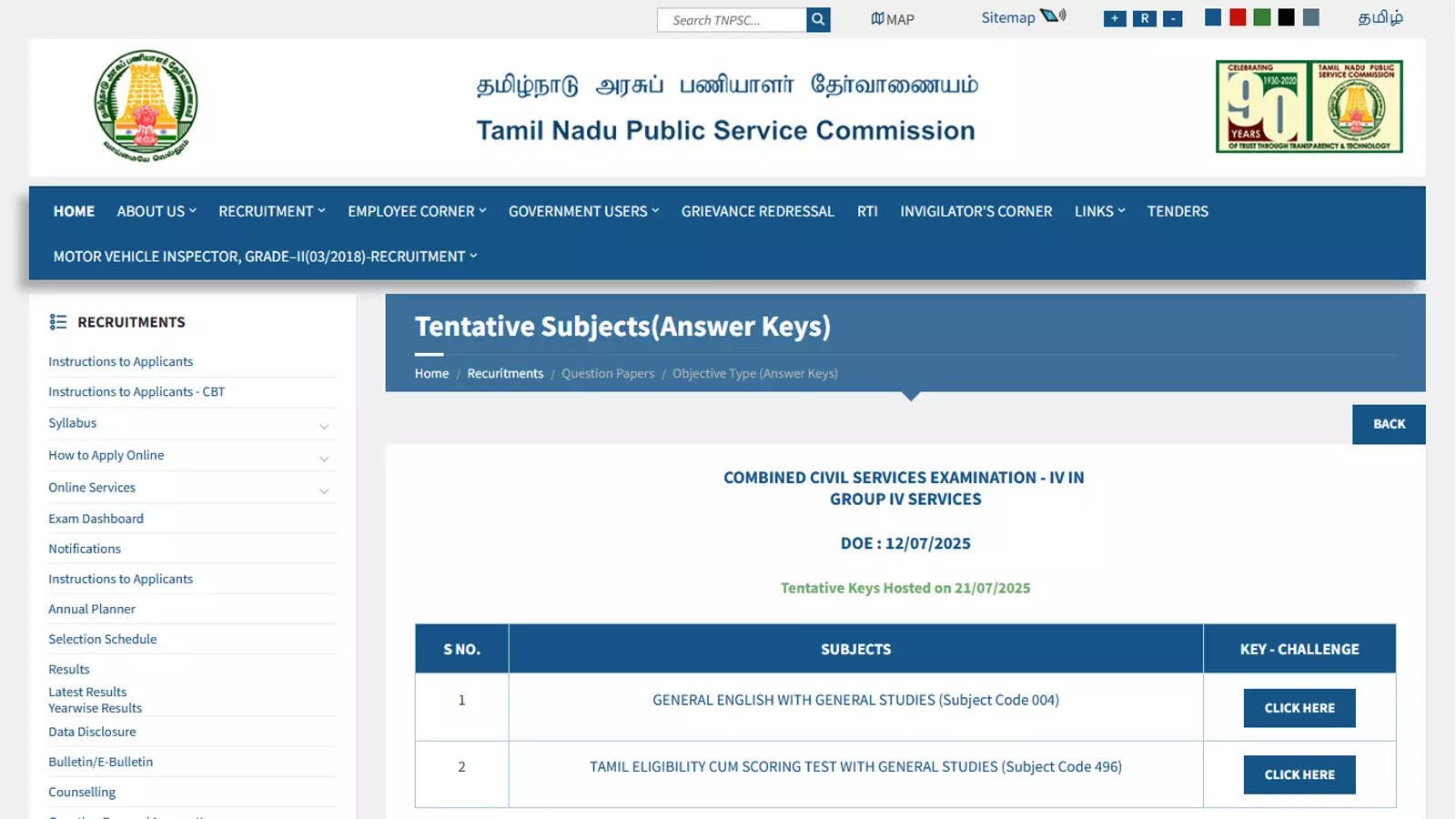

Sebi looks to expand mutual fund categories

2025-07-19

-

-

-

-

Vedanta can seek legal recourse: Ex-CJI

2025-07-19

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Lady Gaga 'Mayhem Ball Tour' iconic moments

2025-07-19

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IND vs ENG | India could hand Test debut to

2025-07-21

-

-

-

-

Just In: 2 big blows for Team India ahead of

2025-07-21

-

-

-

-

-

-

-

-

Cricket | ECB pip BCCI; WTC final to stay in

2025-07-21

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

'Fantastic Four': All about the movie

2025-07-21

-

-

Meet Ahaan Panday's mother, Deanne Panday

2025-07-21

-

-

-

-

-

Sushmita Sen spotted with ex-bf Rohman Shawl

2025-07-21

-

-

-

-

‘Saiyaara’ OTT release: Here's what we know

2025-07-21

-

-

‘Kantara Chapter 1’ new making VIDEO out

2025-07-21

-

-

'Junior' earns Rs 5.40 Cr on first weekend

2025-07-21

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IND vs ENG: 'Everybody wants to be No 1' -

2025-07-21

-

-

IND vs ENG: 'It was 11 vs 2' - Harry

2025-07-21

-

-

-

-

-

-

-

What does 'Saiyaara' really mean?

2025-07-21

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

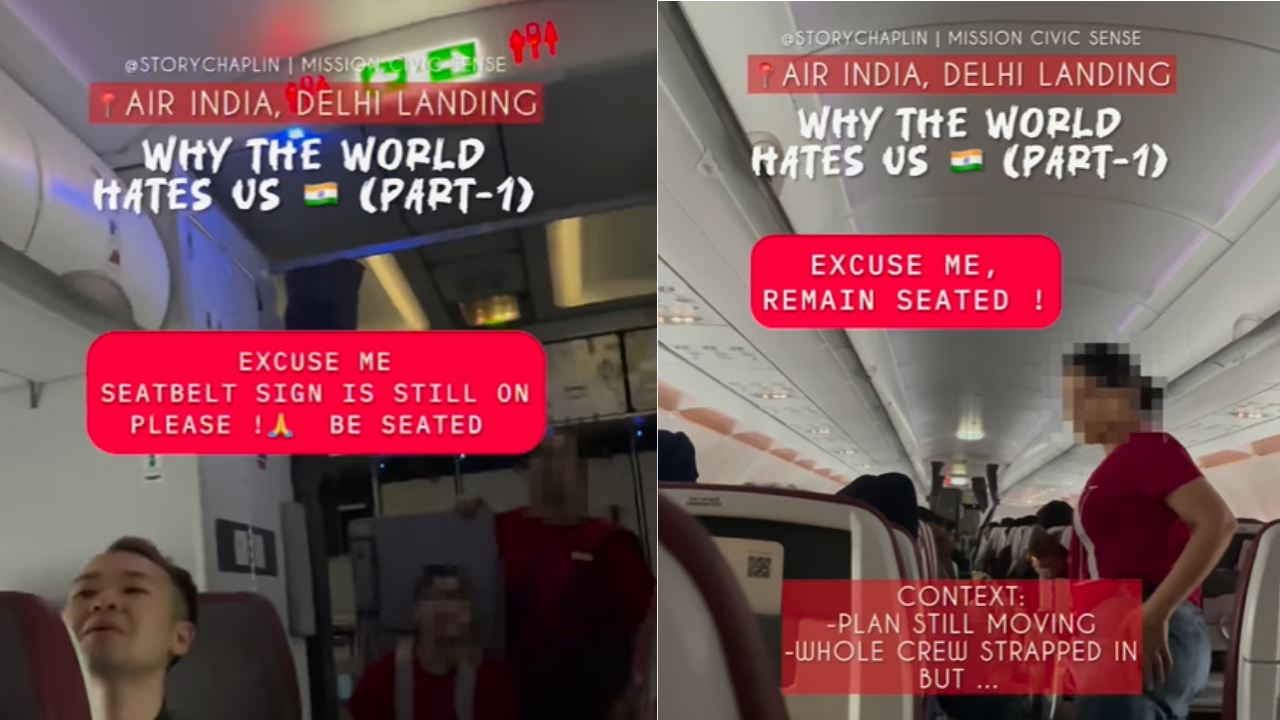

'Who is to be blamed?': Paid Rs 2.5 lakh to

2025-07-22

-

-

-

-

-

-

-

-

-

Vaani was dropped from a film as she was not

2025-07-22

-

-

-

Rapper Emiway Bantai falls from moving car

2025-07-22

-

-

-

-

-

-

Celebs mourn Malcolm-Jamal Warner's death

2025-07-22

-

Box office flops, unforgettable characters

2025-07-22

-

‘Junior’ box office: Genelia’s film sees dip

2025-07-22

-

'Maalik' STRUGGLES to cross Rs 25 crore mark

2025-07-22

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

India's share in US imports inches up

2025-07-22

-

Zomato parent sees Q1 profit plunge 90%

2025-07-22

-

LIC invests ₹5,000cr in SBI's ₹25k cr QIP

2025-07-22

-

-

-

RBI mandates stricter digital banking norms

2025-07-22

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

IND vs ENG: Ben Stokes wins four in a row,

2025-07-23

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

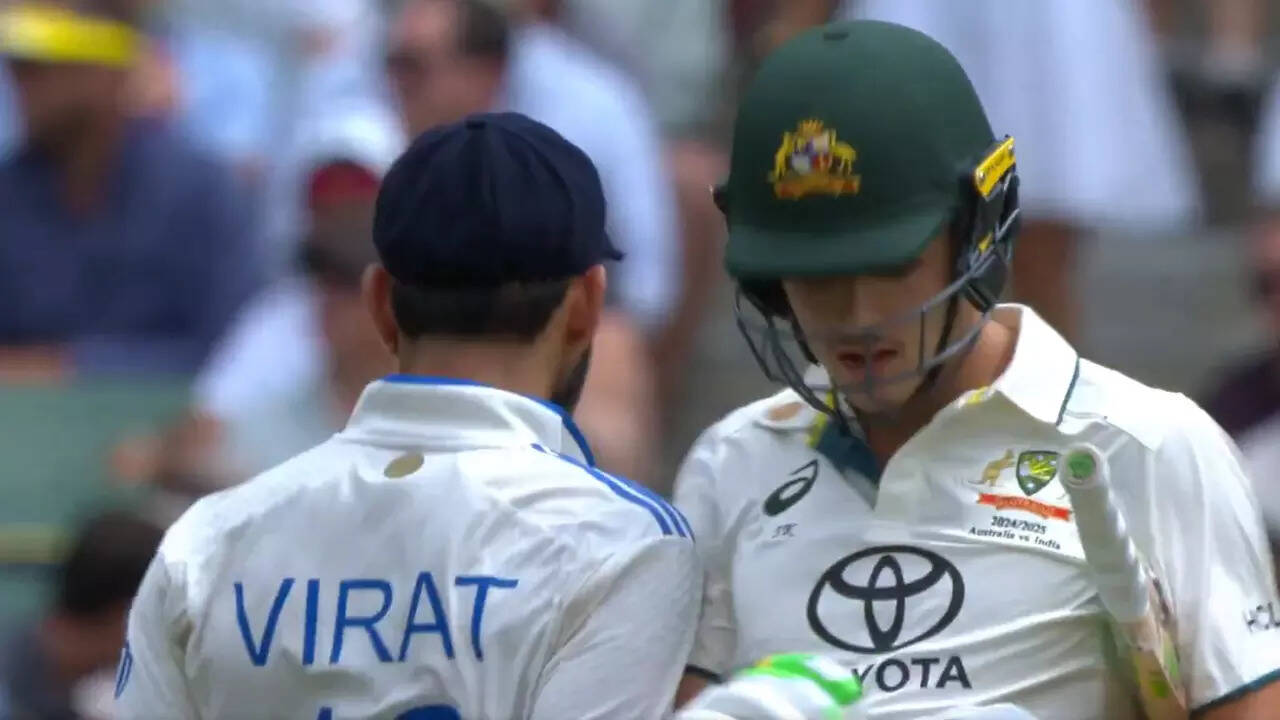

When Virat disappeared from the spotlight

2025-07-23

-

-

-

-

-

-

-

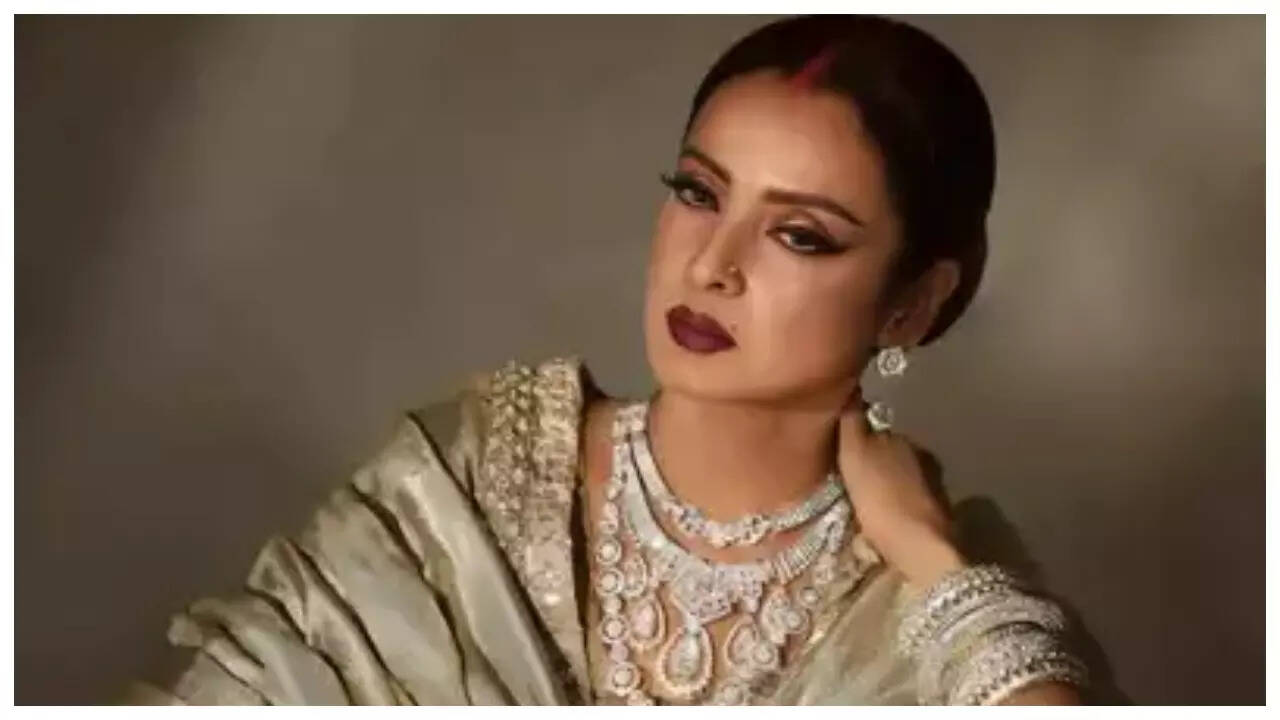

When Rekha revealed her greatest fear

2025-07-23

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

GST lens on UPI pay may push small biz to

2025-07-23

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

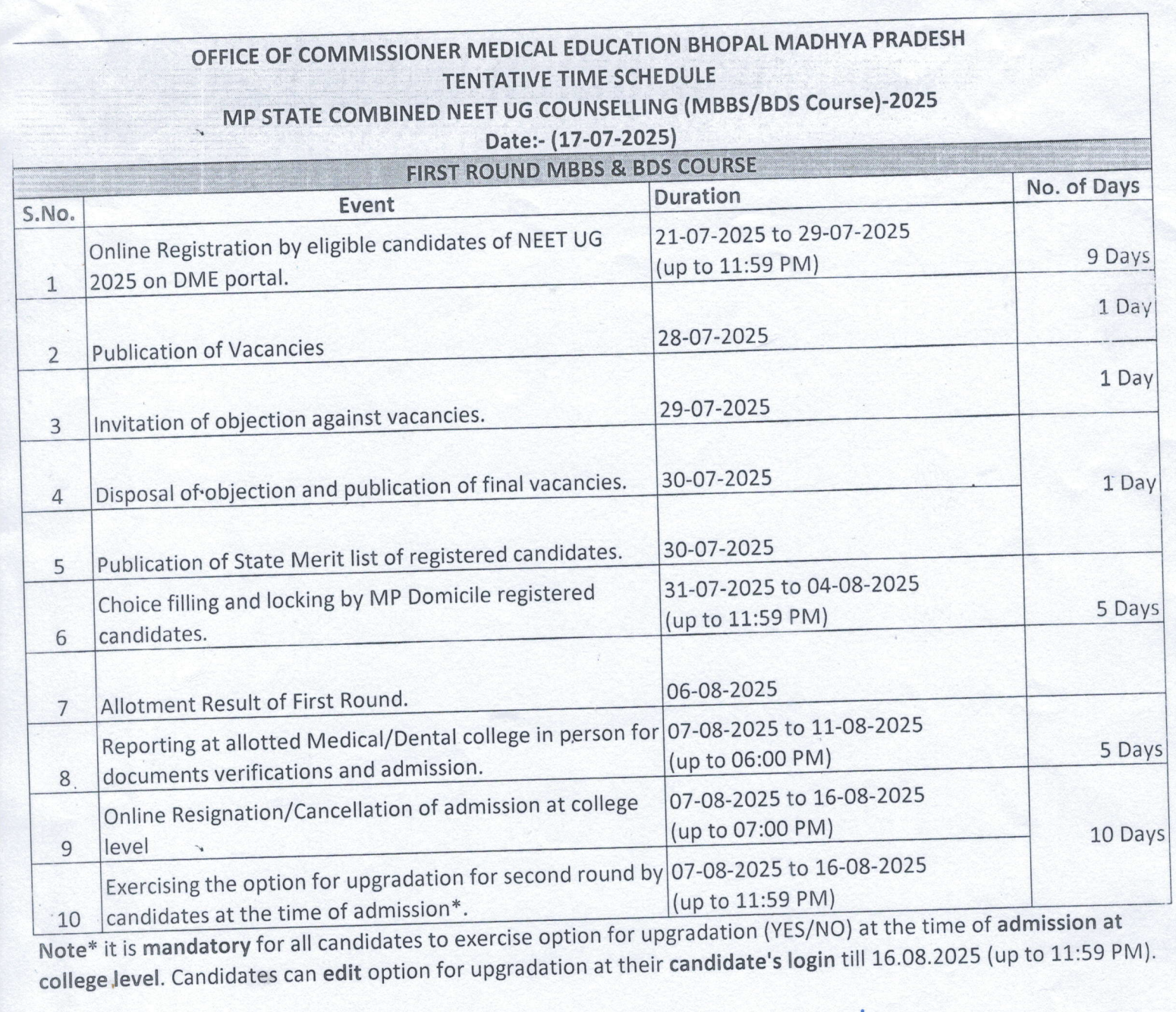

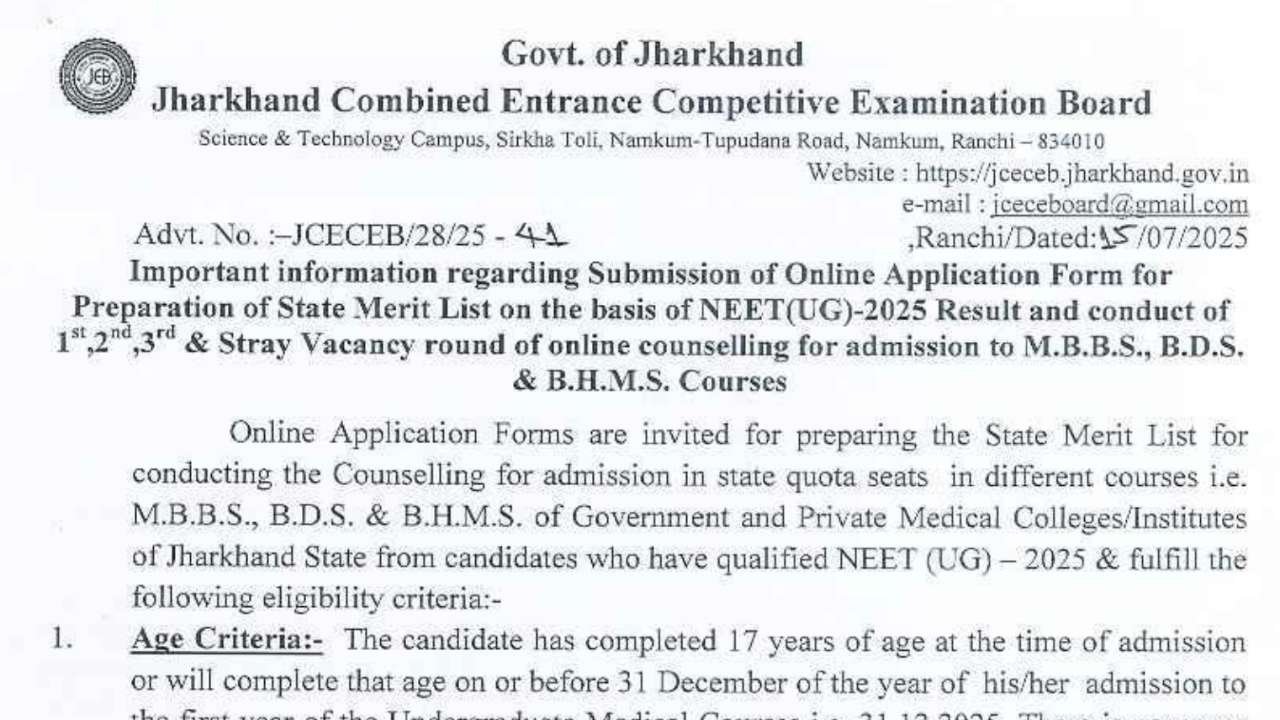

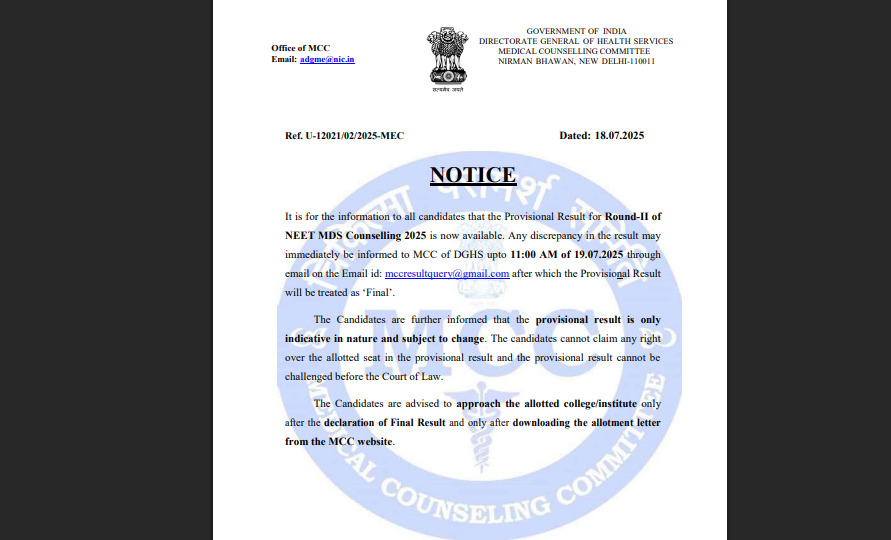

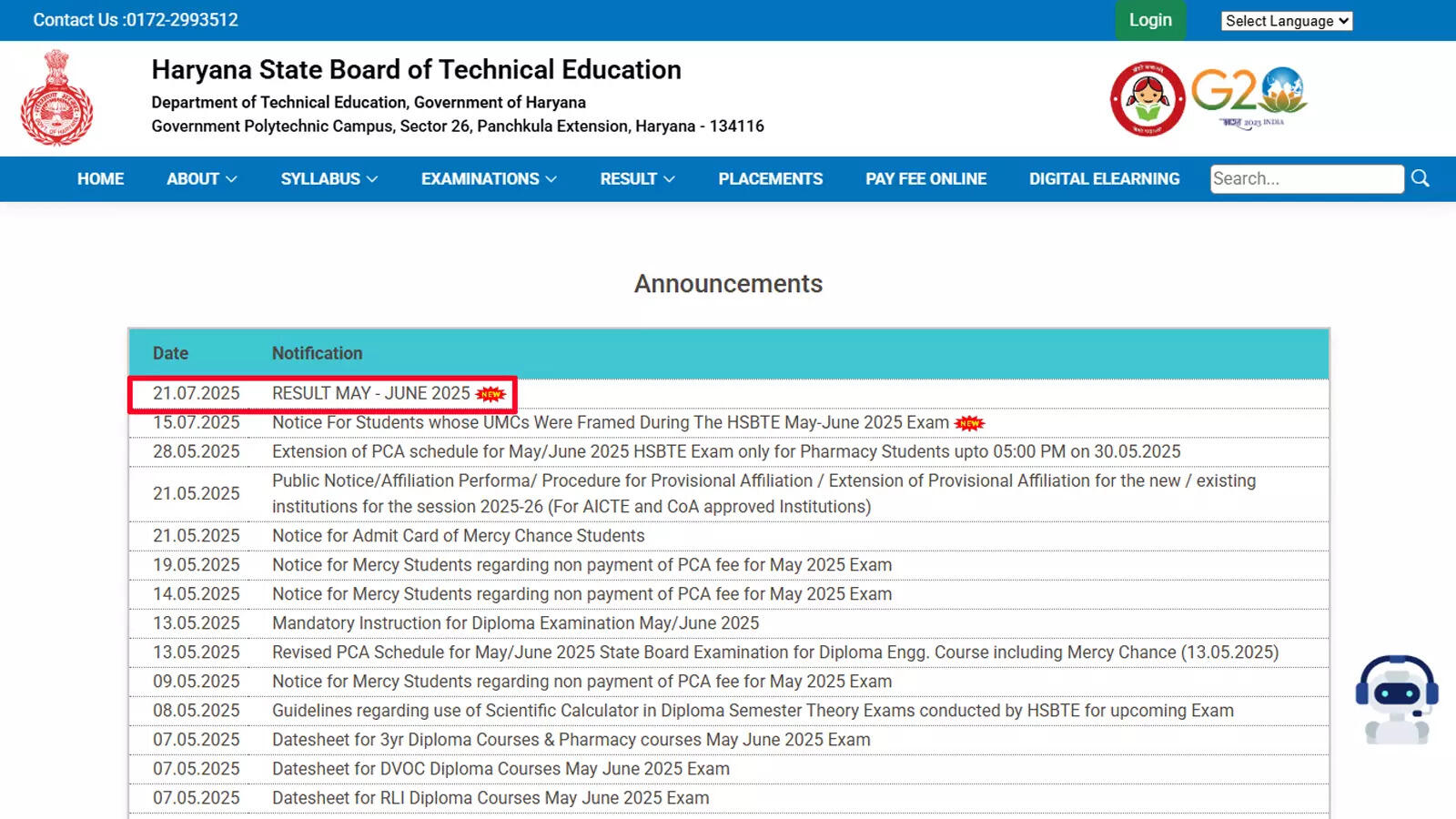

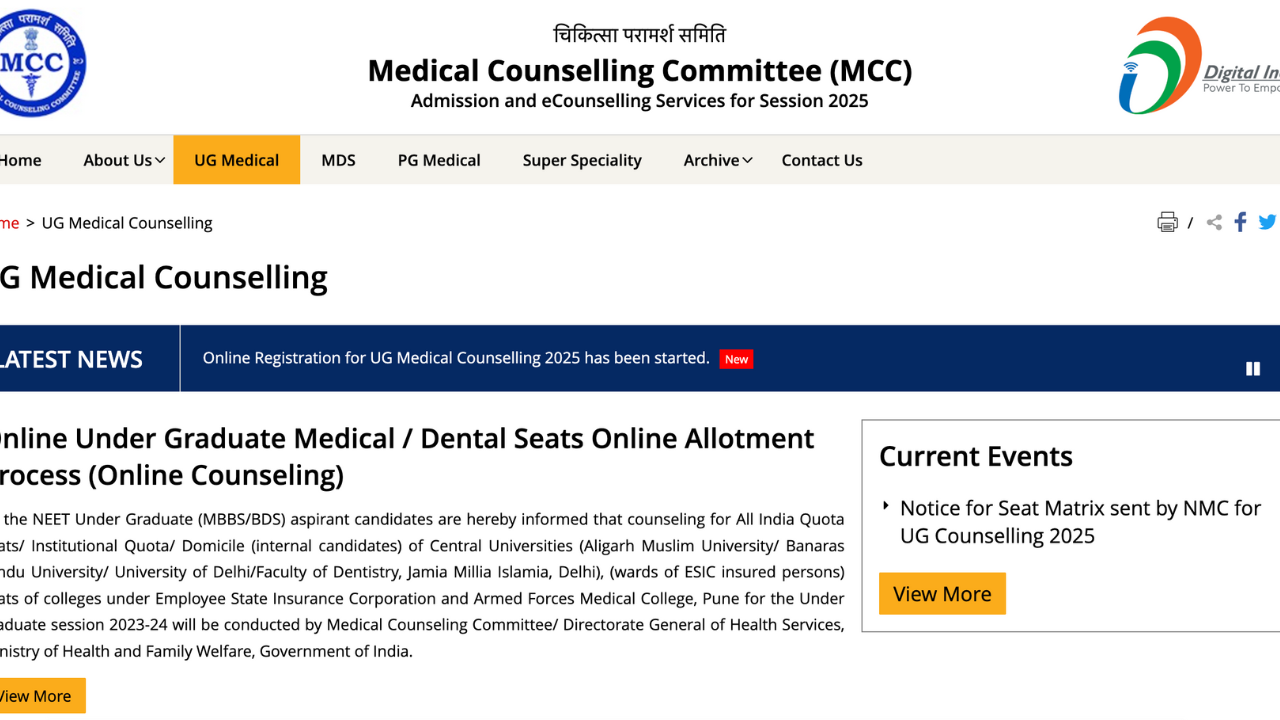

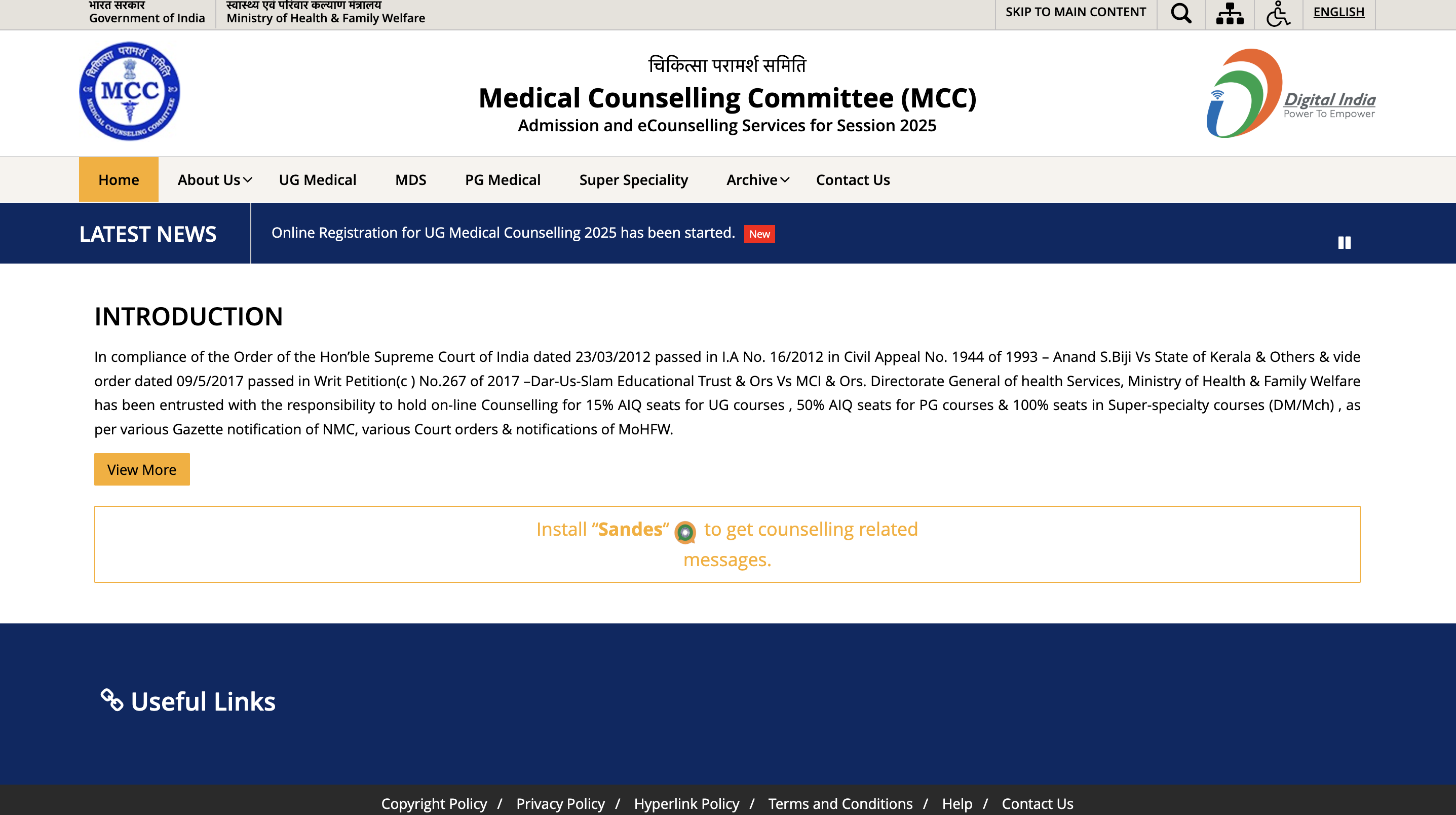

SC turns down plea to stay NEET counselling

2025-07-24

-

-

-

Pant Injury Recap: ‘He was in a lot of pain’

2025-07-24

-

IND vs ENG: Pant a huge blow as India ride

2025-07-24

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Inside Ahaan Panday’s dreamy Bandra mansion

2025-07-24

-

-

-

-

Saiyaara crosses Rs 150 crore on day 6

2025-07-24

-

-

Old pic of Ahaan going down on one knee for

2025-07-24

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Syngene Q1 profit up 59% to Rs 87 crore

2025-07-24

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

Will Saiyaara release on OTT on Diwali?

2025-07-24

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

There may be a swing or a miss, but we

2025-07-25

-

-

-

Judge summons judge to explain bail order

2025-07-25

-

-

-

-

-

No impact on Rel Infra & Rel Power, say cos

2025-07-25

-

-

-

-

-

-

-

-

-

IND vs ENG: 'It was 2 vs 11' - Crawley

2025-07-25

-

-

-

-

-

-

-

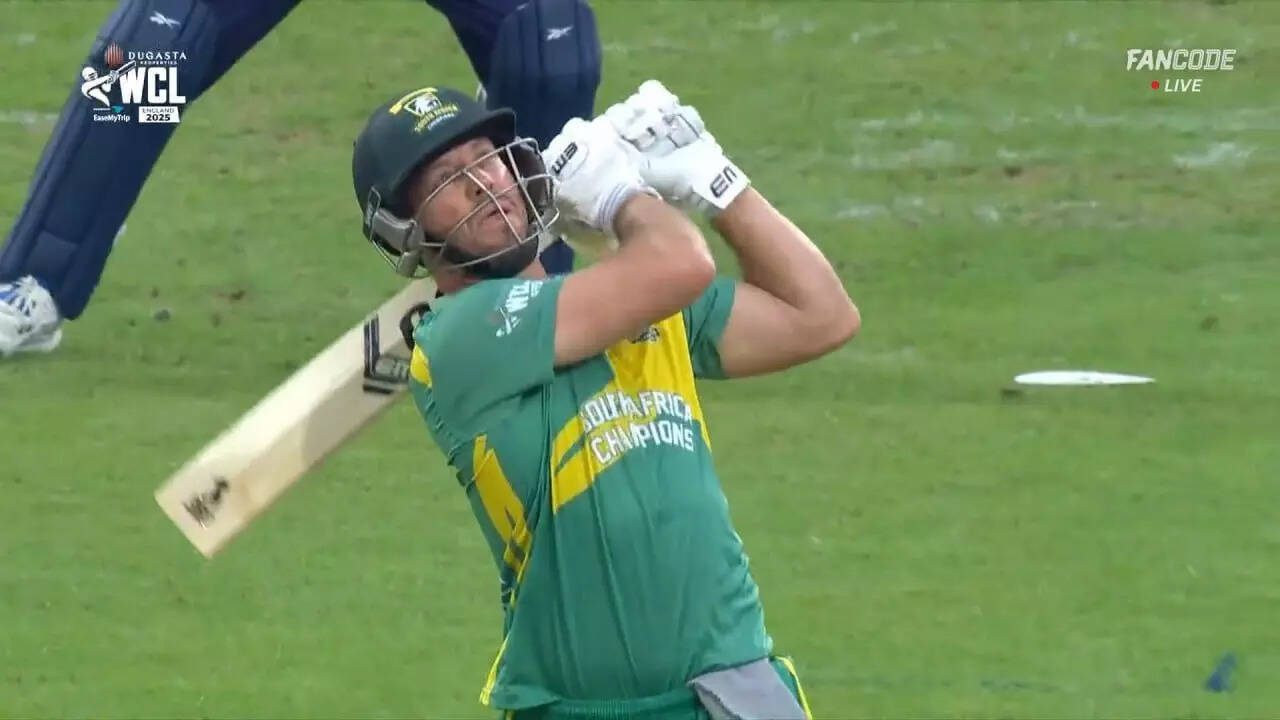

WCL 2025: Mr 360 has still got it! AB de

2025-07-25

-

-

IND vs ENG: Jagadeesan set to be added as a

2025-07-25

-

-

-

-

-

-

-

IND vs ENG : Can Ishan step in as cover

2025-07-25

-

-

-

-

-

When is Humpy vs Divya in the final? What is

2025-07-25

-

-

-

-

-

-

-

-

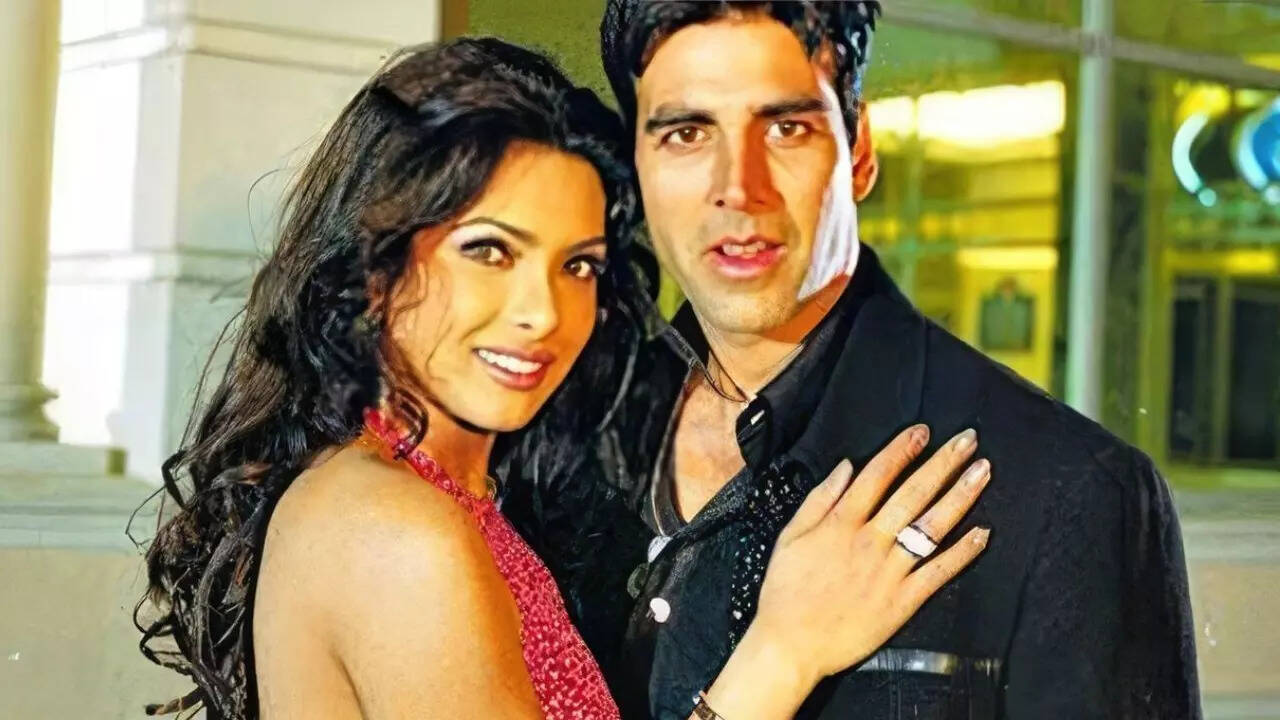

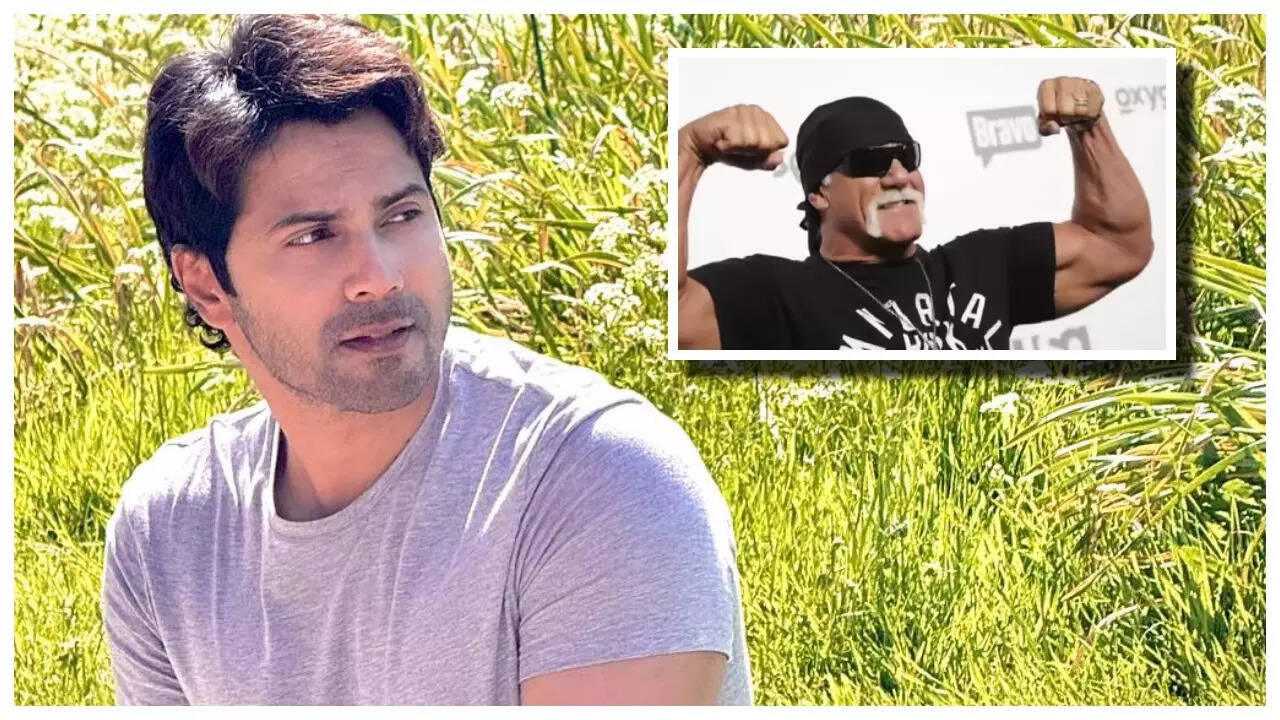

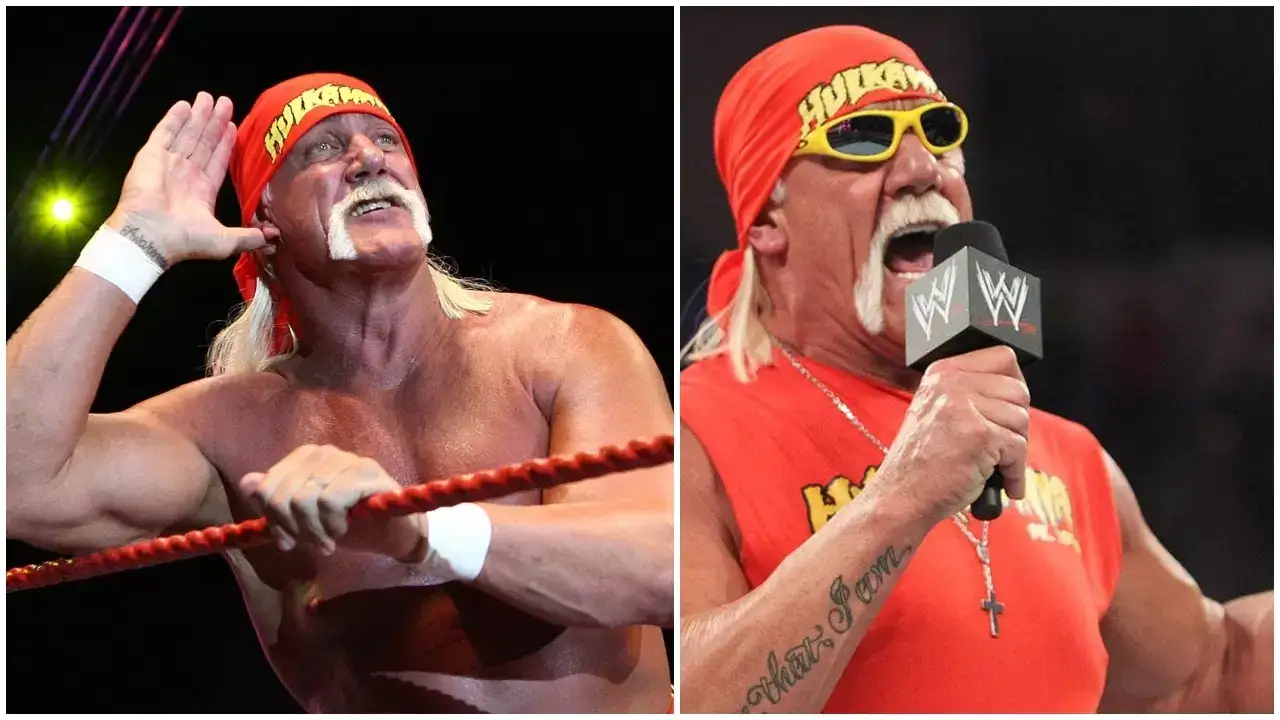

Varun Dhawan pays tribute to Hulk Hogan

2025-07-25

-

-

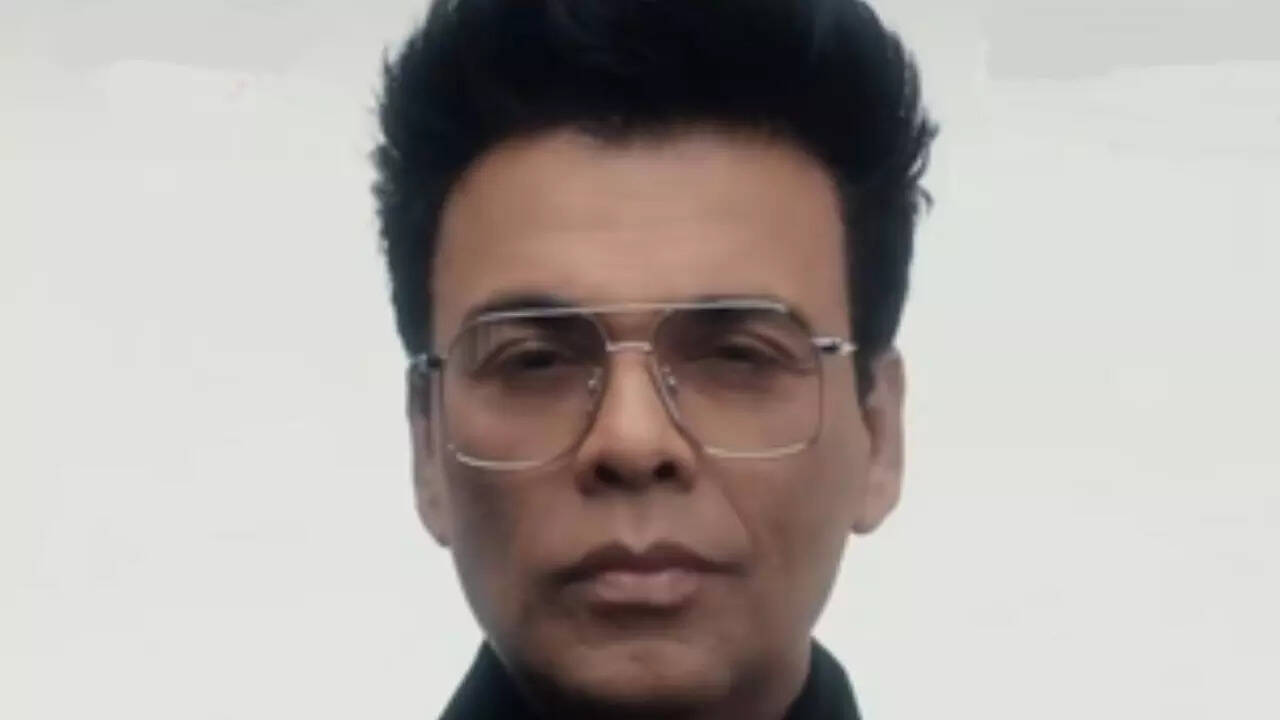

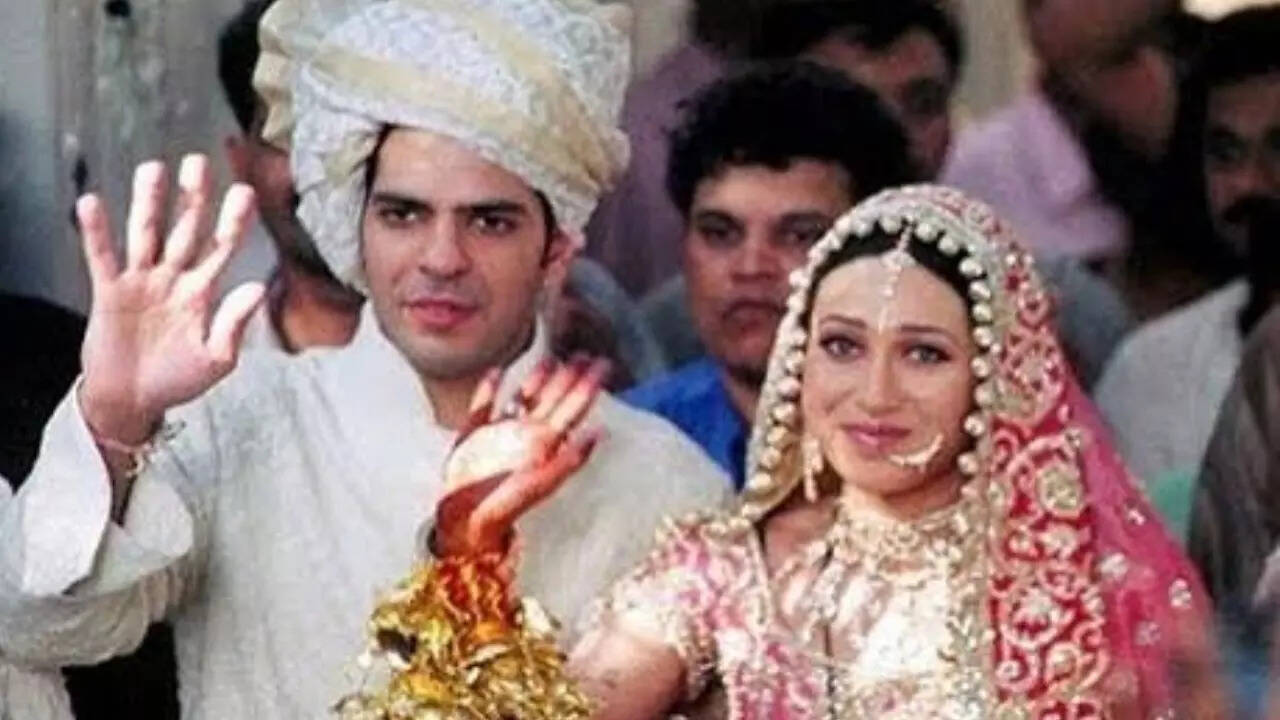

Karan opens up on 'OK Jaanu' failure

2025-07-25

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

PhysicsWallah’s IPO gets nod from Sebi

2025-07-25

-

Canara Bank profit rises 22% to Rs 4.8k cr

2025-07-25

-

Bajaj Fin net profit up 20% at Rs 4.8k cr,

2025-07-25

-

Irdai moots internal ombudsman

2025-07-25

-

-

Choices widen: More British brands in mix

2025-07-25

-

-

-

-

-

ED jolts Anil Ambani grp's fragile recovery

2025-07-25

-

-

-

-

-

-

-

-

-